INTRODUCTION

Management accounting can be defined as per the Institute of Management Accounting that it is a profession that deals with management decision-making, expertise in formulation and implementation of strategies and assist management in planning and performance of management. UCK Furniture is a well renowned company of UK which is engaged in a business of manufacturing furniture products that is they manufacture in mainly two sectors which are tables and drawers. This company is a well established firm having a huge turnover and popular in the sector of satisfying customer to a great extent. This report specifies that UCK Furniture is planning to start a training programme for new interns in September 2016.

TASK 1

1.1 Calculating costs using absorption

1.2 Applying range of management accounting techniques

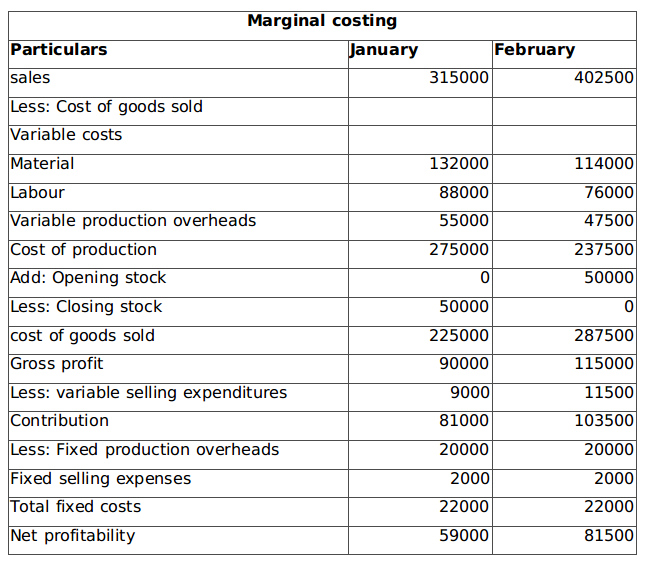

Marginal costing and Absorption costing can be considered as management accounting techniques for cost analysis. Marginal costing can be defined as the technique of showing the data related to the costs where variable costs as well as fixed costs are presented seperately for making better decisions and to find out the overall profitability of a company. If the amount of sales fall in a given period then the profit will automatically fall by the same amount. Fixed production overheads are not considered in marginal costing so as to avoid the effect of varying charges on each unit(Azizi and et.al, 2010, June.)

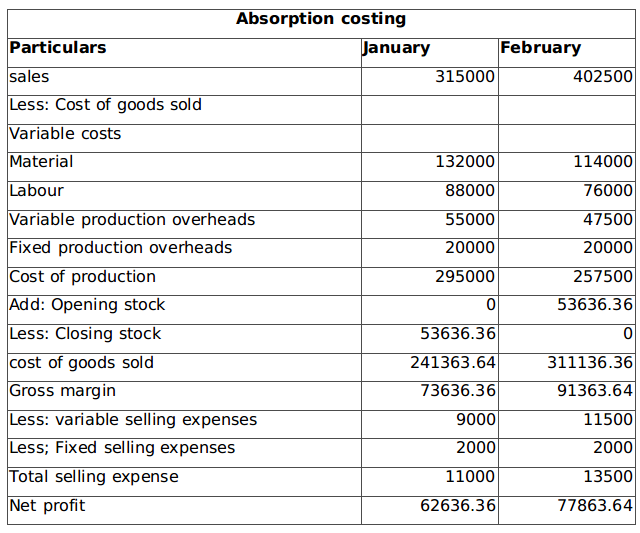

Absorption costing considers fixed overheads that is it considers both direct as well as indirect cost to assess the profitability of the company. All expenses associated with the manufacturing of a product are included in the absorption costing.

1.3 Interpretation of the data

As per the above data, it can be interpreted that absorption costing includes fixed overheads unlike marginal costing that's why there is a difference in the profitability of marginal and absorption costing. Because of the adjustment of the fixed overheads in both the techniques, there is a difference in the valuation of opening and closing stock of both the months. In marginal costing s tock is valued at 50000 but in the absorption costing stock is valued at 53636.36 because of the fixed charges of 2000.

TASK 2

2.1 Advantages and Disadvantages of different types of budgetary control

- Bottom-up budgeting: This budget contains the better information as employees themselves set the budget as well as it enables better communication between the departments. Its disadvantage is that decision-making is sometimes bad as it is taken by less experienced managers.

- Top-down budgeting: This budgeting has a greater advantage of better control of managers as budget is mainly set by the senior managers (Managerial Accounting, 2012). Its disadvantage is that there is no communication between the departments and top managers doesn't listen to the employees regarding any complaints.

- Zero-based budgeting: Zero based budgeting are considered to be flexible budgets that is whenever we want to change anything in our budget in future it can be changed. But it has a shortcoming of resource and time constraint. It takes a lot of time to be prepared which is a major drawback.

Student may also like to read: Management Principles Level 5 HND Diploma Business

TASK 3

3.1 Comparing how organisations are adopting management accounting systems to respond to financial problems

Return of capital employed(ROCE): Operating profit/ capital employed

UCK Furniture:

- Design Division: 5890/23100 *100 = 25.5%

- Gear Box Division: 3600/31930*100 = 11.27%

- UCK Woodworks = 6955/81230*100= 8.56%

Operating Profit Margin: Operating income/ net sales

UCK Furniture:

- Design Division: 5890/13000*100= 45.31%

- Gear Box Division: 3600/24900*100= 14.46%

- UCK Woodworks: 6955/15580*100= 44.64%

Interpretation:

As per the above calculations, UCK woodworks which is a competitor of UCK Furnitures has a lower return on capital employed. Return on capital employed measures the profitability of the organisation and helps in better decision making. Design Division of UCK Furniture has the highest return on capital employed which is 25.5% followed by the Gear Box Division of UCK Furniture. UCK woodworks has the lowest profitability so they have not adopted management accounting systems in an efficient manner. But this is opposite in the operating profit margin as UCK woodworks has the operating profit of 44.64%. Design division of UCK furniture has the highest operating profit margin of around 45%. Gear Box Division of UCK Furniture has the lowest operating profit margin. Therefore, Design Division of UCK furnitures has the highest profitability and measures the highest performance.

3.2 Analysing management accounting can help both the companies to achieve success

Management accounting system helps the companies in achieving success as this system provides financial expertise, skills and knowledge related to the management in order to ensure efficiency and effectiveness. It is considered as an effective tool for decision making in the company which helps the managers of the companies to strive for success. Costs related to each department, expenditures etc. are estimated and budget is made accordingly which will help both the companies to survive in the market. Their actual costs should be compared to the standard costs to maintain profitability(Macintosh and et.al, 2010)

UCK Furnitures and UCK woodworks both the companies adopt management accounting systems to achieve success in the market. Management accounting system helps the companies in improving liquidity in the organisation. UCK Furniture deals with two different divisions and UCK woodwork is the competitor of the UCK furniture and both the companies adopt management accounting systems then also UCK furniture is more profitable on the basis of the financial tools used.

Management accounting system used by the companies also increases financial returns as they are the best tool to be considered for decision making. This helps in achieving success for the organisation as better decisions ultimately leads to success(Fullerton and et.al, 2013)

3.3 Evaluating the planning tools used by the companies to reduce the financial problems

- Budgetary control:

This tool is used by the organisation in order to predict future requirements and these future needs are arranged in such a manner so as to take decisions effectively. This technique is used to analyse the performances of the business and all the budgets are prepared in a desired manner. These standard costs are compared to the actual costs in order to analyse the profitability of the company to achieve success. - Project Evaluation:

This tool is used by the management to assess the overall project efficiency. Its main objective is to check the level of effectiveness as well as sustainability. Project should be properly evaluated and checked by the manager so as to formulate policies and procedures to achieve success. - Standard costing:

Standard costing is another important tool used by the companies in order to analyse predetermined cost in the organisation. This cost is then compared with the actual costs incurred in the manufacturing organisation like material, labour, overhead costs. Standard costing is used to find out the reasons of the deviations(Cinquini and et.al, 2010.) - Cost Variances:

Cost variances helps the managers to correct and control the variations from the standard costs. They act as a very useful tool in achieving success by analysing the variations. It helps financial managers to detect the deviations by considering different types of variances like profit volume variance, material cost variance, labour cost variance etc(Zimmerman and et.al, 2011.) - Ratio Analysis:

This tool is used by the management in order to carry out different functions of planning, forecasting, evaluating and analysing the financial statements. It helps the managers in reducing financial problems by estimating the sales and profit in advance and to meet different targets.

Related Service- Accounting Assignment Help UK

CONCLUSION

As per the current study on management accounting it considers the concept of management accounting that why it is useful for the managers to achieve success in the organisation and improve profitability. UCK furnitures has adopted various tools and techniques for decision making. Standard costing, ratio analysis, cost of variance analysis, budgeting etc. has been used to improve an efficiency. Management accounting systems have been adopted by the organisations to reduce various costs, and to increase the financial returns.

REFERENCES

Books and Journals

- Ajibolade and et.al, 2010. MANAGEMENT ACCOUNTING SYSTEMS, PERCEIVED ENVIRONMENTAL UNCERTAINTY AND COMPANIES'PERFORMANCE IN NIGERIA.International Journal of Academic Research, 2(1).

- Azizi and et.al., 2010, June. Energy-performance tradeoffs in processor architecture and circuit design: a marginal cost analysis. In ACM SIGARCH Computer Architecture News (Vol. 38, No. 3, pp. 26-36). ACM.

- Cinquini and et.al., 2010. Strategic management accounting and business strategy: a loose coupling?. Journal of Accounting & organizational change, 6(2), pp.228-259.

- DRURY and et.al., 2013. Management and cost accounting. Springer.

- Fullerton and et.al 2013. Management accounting and control practices in a lean manufacturing environment.Accounting, Organizations and Society. 38(1), pp.50-71.

- Gupta and et.al 2010. The implications of absorption cost accounting and production decisions for future firm performance and valuation. Contemporary Accounting Research, 27(3), pp.889-922.