Question :

This assessment will cover the following questions:

- Analyses the KPMG Companys use of planning tools to ensure financial stability and performance as well as ways in which management accounting has played a key role in preventing and solving financial problems.

- Compare ways in which management accounting is implemented in dealing with financial problems and preventing financial problems in an organization.

- KPMG is a famous accounting firm that provides services to different clients. Apply a range of management accounting techniques.

Answer :

INTRODUCTION

Management accounting is defined as a set of methods and techniques which is used for preparing reports and accounts to present the actual situation of business operation. These reports are helping to managers to make short-term and long-term decisions. It supports a business to pursue its goals by identifying, measuring, assessing, interpreting and communicating information with managers (Anderson, 2017). To better understand the report selected company KPMG which is a famous accounting firm that provides services to different clients like Excite Entertainment Ltd. This client company is part of the entertainment industry and provides services in leisure as well as entertainment. This report involves different systems and reports that use to present the actual situation of the company and their benefits. Along with, using both methods to calculate profitability and it tried to formulate the importance of costing techniques. Additionally, sort out the financial problem and applied the assumption of break-even analysis.

TASK 1

Section A

Management Accounting Systems

(a) Differences between management accounting and financial accounting

The term of management accounting refers to a technique that is applied by organisation in order to analyse various business activities which is being gathered from different departments available within the company. This technique mainly applied by large level business entities due to recognise their status at the market. On the other side financial accounting is a form of accounting in which keep track all financial information of an organisation and apply specific guidelines as well as transactions to present financial report (Spraakman and Quinn, 2018).

|

Management Accounting |

Financial Accounting |

|

There are reports are preparing by organisation to present all the internal parties of the business like employees, stakeholders etc. |

Reports and accounts are preparing to present all the external parties like customer, suppliers etc. |

|

To prepare all the accounts accountant does not follow GAAP principles and rules. |

In financial accounting must follow the rues and principles of GAAP. |

|

In this accounting include both types of information financial or non financial (Bertheussen, 2017). |

There are including only financial information. |

|

Management accounting concentrate on different segments of business. |

In case of this accounting focus on the whole organisations. |

(b) Cost accounting systems

This system mainly applied by the manufacturers to keep track record of production activities. It is one of the significant system that is applied by system to recognise cost of organisational goods & services. Through this system assessing profit margin and analysis stock and control cost as per the requirement. This is considered as a significant element help in identifying cost of the company incurred within the whole production process. This is the system which is fundamentally needed in order to identify the costs included within the Excite entertainment Ltd in order to accomplish their goals and objectives. This system categorised into two way such as:

- Direct cost: There are consisting of all those expenses which are related with the different business activities.

- Standard costing:It is a type of costing in which Excite entertainment gather all appropriate information in regard of standard and actual cost.

(c) Inventory management systems

It is one of the leading system which is applied by the different types of organisation in order to denotes goods and available for sale to customers. Through this system assess the raw material at every manufacturing stager and analysis the requirement. It is effective system that use by Excite entertainment to manage and controlling all the inventory items. The rationale behind maintenance of inventories is to acknowledge the expected enhancement within demand, protecting against unanticipated enhancement within needs and for having edge with respect to price breaks for making orders within a bulk (Bushee, Jung and Miller, 2017).

(d) Job costing system

The particular system connected with procedure of aggregating data and facts in case of various costs/expenditure in which related with particular job. This is also significant in allocating or pointing key areas of operations within organisation which are responsible for increasing costs within enterprise. Also this systems enables managers in effective implementation of key strategies linked with minimisation of costs and increasing profit margin. This require detailed analysis of costs for deriving more accurate and precise results as any error in implementation of this systems may lead to erroneous decision-making.

(e) Analysis the benefits of different systems

Excite Entertainment Ltd apply various types of management accounting system which is beneficial for operational activities of business entity. There are defined benefits of these system underneath:

- Cost accounting system: It is beneficial system that use to examine different cost which is related to organisational procedure (Tapis, Priya and Mahon, 2017). Furthermore, Excite entertainment Ltd use it to examine cost of all the business activities and fund will be allotted as per the requirement.

- Inventory management system: This system supports to track stock and maintain proper records that is utilised by business concern. Its main functionality is Excite entertainment limited keep al records of inventories which is utilised and support to business to control stock and avoid wastages.

- Job costing system: It present main function to deduct as well as enhance labour units allotment to various tasks in the manufacturing procedure. The manager of Excite entertainment limited selected this system as best alternative to keep track record of various functions that are performed to fulfil the requirement of clients (Corsi, Mancini and Piscitelli, 2017).

Section B

(a) Management accounting reports

Management accounting reports is procedure of creating various reports where consist of numerous data in context of company's efficiency. These reports are developed by the manager of Excite entertainment Limited to analysis the performance and take right decision. The main aim of produce these report to assess actual position of company in critical situation and how to deal with these situation. In the context of Excite Entertainment develop different reports such as:

Inventory management report: Inventory means goods that produced by business entity to sell out products and services. The purpose of produce this report to generate more income through these reports. In the context of Excite entertainment Ltd produce these reports by including appropriate information that link with the control and proper utilisation of inventories (Dávila, 2019). Through this report analysed that in which stage how much material utilised and wastages to control it.

Cost accounting report: This report prepare by manager to gather, categorise, examine and reporting the data for ascertaining the cost of products as well as service. It supports to compute the efficiency of cost and arrange within the industry. Such as, excite entertainment limited produce this report for divided cost in to different cost centres and setting as per the trend of market. This is helpful report which is utilised for cost of products and assure by the transactions that done by business entity.

Performance report: The particular report produced by managers in order to assess the performance of business entity and staff members to achieve goals. It is mainly utilised for analysing the performance of entertainment industry and enhance efficiency to become profitable. Such as, Excite entertainment Ltd develop these kinds of report to arrange performance of various staff members and apply modifications (Dossi, Lecci, Longo and Morelli, 2017).

(b) Information should be accurate, relevant to the user, reliable up to date and timely

The information should be accurate, reliable and relevant of the company information that present in the organisational reports. On the basis of these information a manager take short and long term decisions and present actual situation of company in front of higher authorities. On the basis of these information companies invest into other sector and conduct all financial transactions. In the absence of reliability manager can not take right decision and face huge losses and these information must present on right time for generate profitability and make plan and policies on time to beat competitors.

(c) Integration of management accounting system and reports

Different kinds of management accounting system as well as reports are prepared by the organisation of Excite entertainment Ltd to analysis all functional and operational activities. The company apply inventory management system to analysis the utilisation of goods at different procedure so through reports collect detail information. The cost accounting system to analysis cost of different products and reports help to analysis past details effectively. While, performance report helps to assess performance of business as well as worker in their task that helpful to run business smoothly (Yang and Liu, 2017).

Student may also like to read: Structure of Education in Schools

TASK 2

Absorption costing and marginal costing

Absorption costing: This technique is applied by cost accountant to calculate cost of each products as per the reason of cost of absorption is known as this method. In the context of Excite Entertainment Ltd, managers applied this method to prepare income statement and calculate profit in context of business (Grabner, Posch and Wabnegg, 2018).

- Benefits: It is advantageous for to understand the role of production cost and analysis all appropriate pricing policy. These prices are mainly depended on absorption costing method in which cover all costs. Through this technique neglect break up all fixed as well as variable elements that can be done appropriately.

- Limitations: The biggest limitation of of this method that it is not easy to calculate and face problem to compare all the results which are getting to calculate profitability.

Marginal costing: It is a accounting system in which variable costs are charged to cost units that has been changed due to add extra unit in total production. Due to changes in variable cost receive different results which are treated under marginal cost and cost of product. As excite entertainment Ltd apply this method due to increase extra units of any products.

- Benefits: It is a beneficial method which is easily applied by every organisation and easy to understand. On the basis of this method they prepare different types of policies and strategies to smoothly run all operational activities.

- Limitations:There are facing high level of problem that assesses by manager due to classifying cost in the costing and cost remain variable for longer period of time.

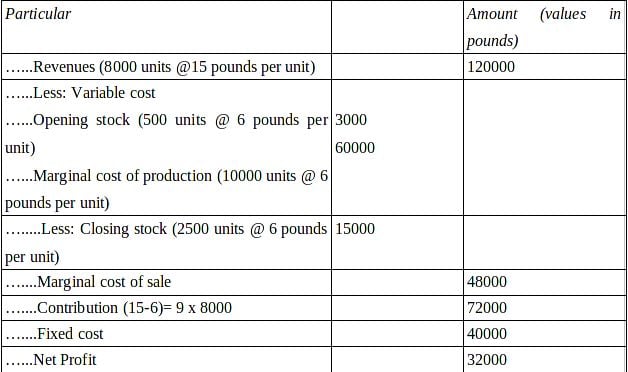

Income statement as per marginal costing:

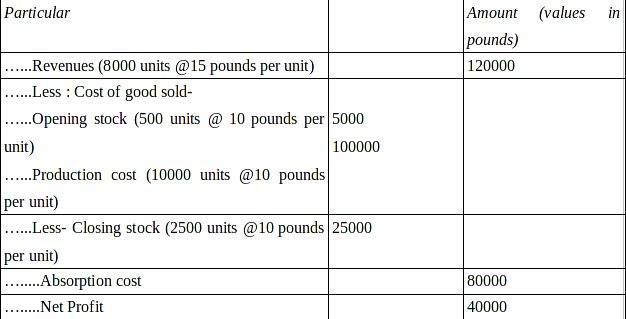

Income statement as per absorption costing:

TASK 3

PART A

Compare and contrast planning tools in management accounting

Budget: It is a estimation of revenues and expenditure in particular set period of time which is mainly compiled and analysis on a periodic basis. Budgets can be made for an individual, organisation, groups and for many others to predict future activities and according to that prepare all the strategies (Herasymovych, 2017). In the context of Excite entertainment limited prepare of budget in order to analysis of potential situation of company. There are applied three types of planning tools in order to assess information of company such as:

Zero based budget: It is a repeatable procedure in which a business entity utilise to rigorously review each dollar in financial year budget, arrange financial performance on monthly basis and develop a culture cost of management among of all staff members. All the expenditure must be justified for particular period of time. This procedure start from Zero where all the functions analysed from staring and not taken past year experiences as a base. The excite entertainment limited apply this tool to analysis all the department from starting and calculate actual cost (Hosseinzadeh and Davari, 2018).

- Advantage: The main advantage of this budget that it is flexible, concentrate on the operational activities, lower cost and more disciplined formulation. Each year preparation of zero based budgeting improve efficiency and help to analysis income and expenses every year.

- Disadvantage: Some expenditure of an organisation is challenging to judge and require not. This method is mainly depended on the cost as well as benefit analysis in certain period of time. There are consisting of possibilities of resources intensiveness being converted by savvy managers.

Master Budget: It is defined as costly business strategy that documents expected potential sales, manufacturing levels, purchase, potential expenditure incurred etc. The master budget is total of all the sectional budgets that is produced by all the departments. Moreover, it consist of cash flow forecast, financial planning, cash flow predication and budging P&L of the company. In the context of Excite entertainment limited prepare of this budget to get summary all divisional budget.

- Advantage: It is beneficial for owner of business because it helps to recognise issues of every department that helps to produce different strategies for longer period of time. It present summary of all budgets that helps to take decision in regard of business.

- Disadvantage: It is expensive method that is not afford by every organisations as well as take longer period of time. In this budget contains information of every department so take more time and require experts who have experience to prepare of these type of budget other wise all results are coming wrong (Ishanka and Gooneratne, 2018).

Cash Budget: It is another planning tool which is applied by organisation to predict future condition in context of cash. In cash budget consist of of all cash receipts, and payments that done in future in particular accounting year. Such as, Excite entertainment limited manager analysis future condition and focus on those transactions that can be done in future for particular things. Additionally, cash budget is utilised as per the payments and assessing variances in inflow and outflow of cash.

- Advantage: It is beneficial for an organization that provide detailed information about cash and helps to predict liquidity condition. This budget supports to avoid any debt circumstances that further result is acquiring right in context of current cash at work place. Through this budget manager easily analysis of actual situation of company and how to change due to different expenditure (Kim, Schmidgall and Damitio, 2017)..

- Disadvantage: It become reason of distortion because of do not provide right cash inflow profit. No credit transactions are consisting in the cash budget that create problem to fails in providing right position of an organisation. There are defining limits of particular areas of spendings that create problem in further investments.

Use of different planning tools for forecasting and predicting budget

To predict the situation of business in future require to apply different types of planning tools which are applied to analysis the present situation. On the basis of present situation apply cash, master and zero based budget that helps to forecast situation in future and how to prepare strategies according to it. The master budget is summary of all the budget that provide results in short manner, the cash budget provide information about liquidity in order to analysis cash inflow and outflow. The zero based budget helps to analysis all sections from starting and help to know strength and weakness of each department.

Students also like to check: Management Assignment Help

TASK 4

PART B

Dealing with financial problem

Financial problems are those problems that arise in business due to have less financial resources and complete all different activities as well as operations. It is required for the different business concern to execute different strategies and take right decision so that all of them could be sorted effectively (Kornberger, Pflueger and Mouritsen, 2017). In the context of excite entertainment limited face different types of problems that are mentioned below:

- Lower profits & revenues: This type of financial issue origin in the company when continuously level decreasing sales of company. It impact on the profitability in direct manner and company face problem of lack of liquidity. This problem has been sorted by the Benchmarking in which is helping to get minimum expected result that set by the company. It is a measurement tool that measure the performance from another company to identify all strategies.

- Unforeseen expenditure: In entertainment industry government change any type of tax rate and other rates that direct relate with the entertainment. These are creating problem for the business and taking place suddenly. As a result the manager of excite entertainment limited apply various monetary sources to over come from the particular situation. To analysis this problem apply key performance indication where consist of both types of information like financial and non financial. According to that business measure the performance and identify the problem (Lamberton, 2017).

Comparison between both organizations

|

Basis of comparison |

Excite limited company |

PC clothing limited company |

|

Financial issue |

In this company identify the issues of lower profit and margin due to decrease sales in particular period of time. It create problem for the business and their funds & reserves use to pay their debts and performing activities. |

The financial problem identify in this company of sudden expenses that arise in the company any time and create problem in organisational procedure. Due to this problem do not predict actual situation of business entity. |

|

Technique |

To identify this problem in the company apply method of benchmarking in which compare strategies with same industry company and identify all the points that create problems. |

To recognise this problem require to apply key performance indicator that helps to categorise activities into financial and non financial manner. There are focusing those expenses that increase cost of business. |

|

MAS |

For this financial problem apply cost accounting system where set right cost of each product as per the trending of the market. According to that sell out in the market and fulfil the requirement of business (Oldroyd, 2017). |

There are applying job costing system to in order to analysis cost of different aspects and analysis that expenditure that arises midtime. So according to job role set these cost and smoothly run of business activities. |

Responding to financial problems in management accounting

Every business concern face many problem during to financial year that impact on the organisational procedure. To sort out these problems require to apply management tools like KPI and benchmarking. These are measurement tool that utilise to identify financial problem and provide right solution as per the structure of the business.

Use of planning tools to respond financial problem

Planning tools are applied by the business to aware for the different financial problem that arise in the business any time. Through different types of budget predict these problems and according to that all the strategies in excite entertainment limited to get appropriate results in certain period of times. Cash, master and zero based budget forecast the situation and offer effective solution on right time (Oyewo, Ajibolade and Obazee, 2019).

Calculations:

BEP to attain desired profit = Fixed cost + desired profit / contribution per unit

= 120000+90000

= 210000/30

= 7000 units

Profit of sale of 7000 units

Sales (7000*40) = 280000

- Variable cost = 70000

Contribution = 210000

- Fixed cost = 120000

Profit = 90000

CONCLUSION

As per the above report, it has been concluded that management accounting is part of every organisation that helps to present inner situation that based on the different financial and non financial information. There are producing different types of reports that use to present actual position of the business and how to take effective decision to get profitability for longer period of time. Here are applied planning tools to sort out the financial problems and these tools are cash budget, master budget and zero based budget. There are identify hose financial problem that occur in particular financial year and impact on the business procedure so for this require to apply management accounting system as well as management accounting tools such as key performance indicators and benchmarking.

Students May Also Like to Read: Practices of HRM in Tesco

REFERENCES

- Anderson, M., 2017. Accounting history publications 2016. Accounting History Review. 27(3). pp.279-286.

- Bertheussen, B. A., 2017. Improving management accounting education through the use of interventionist action research. Beta. 31(02). pp.170-183.

- Bushee, B.J., Jung, M. J. and Miller, G. S., 2017. Do investors benefit from selective access to management?. Journal of Financial Reporting. 2(1). pp.31-61.

- Corsi, K., Mancini, D. and Piscitelli, G., 2017. The Integration of Management Control Systems Through Digital Platforms: A Case Study. In Reshaping Accounting and Management Control Systems (pp. 131-151). Springer, Cham.

- Dávila, A., 2019. Emerging Themes in Management Accounting and Control Research. Revista de Contabilidad-Spanish Accounting Review. 22(1). pp.1-5.