Question :

This assessment will cover following questions:

- GSQ Ltd is the manufacturing concern. What methods can be used for management accounting reporting?

- Analyse the drawbacks and benefits of different planning tools for the budgetary control?

Answer :

INTRODUCTION

Management accounting is the process where internal systems are used by organisation for measuring and evaluating the process for management of organisation. Management accounting has been used by organisation for achieving sustainable growth and success in the organisation. GSQ is a manufacturing concern on which present report is based. Report will cover meaning of management accounting and different types of management accounting systems used in the business with their benefits and limitations and their application in the organisation. It will cover the methods used for management accounting reporting. Different techniques of costing used in management accounting will also be explained. Also t will give an understanding about the management accounting planning tools and the use of management accounting in solving financial problems.

You may also like to know - Assignmnet Help

LO1

Management Accounting

Management accounting involves preparation and making available the financial & statistical information’s to the business managers for carrying out managerial decisions for day to day activities of business (Bui and De Villiers, 2017). It is different from financial accounting as management accounting is of importance to internal management where the financial accounting is for external reporting to stakeholders.

Types and benefits of management accounting systems and its application in organizational context.

There are different types of management accounting systems which are used by GSQ ltd.

Inventory Management Systems

Inventory management is a technological and process & procedures combination which oversee maintenance and monitoring of the stocks, whether the stocks are related with the assets of company, supplies, raw materials or the finished products manufactured by the organisation for sale to customers. Inventory management is widely used process that is essential for keeping track of the movement of inventory within the processes and out of the organisation. The methods used in inventory management are just in time and material requirement planning

Just-in-time-

In this method organisations do not tend to store the stocks of inventory in the organisation. Inventory is made available on demand by the production departments which saves the carrying cost and risk of becoming outdated.

Material Requirement Planning-

In this method company stores the inventory that cannot be made ordered on urgent basis. This involves planning about the requirement of inventory base on the previous trends. Bulk purchases provide discounts.

Benefits

- Inventory management systems helps GSQ to have proper record of all the movement of inventory.

- It also helps the company to reduce its costs using the approaches like just-in-time and MRP.

- Inventory prevents interruptions in production process as it helps company to order in time.

Application

Inventory management is applied in the production process for ordering the materials as and when required (Hiebl, 2018). It helps GSQ in having proper record of the inventory stored in warehouse.

Cost Accounting Systems

Cost accounting systems refers to recording all the costs incurred in manufacturing a product. It account for all the direct and indirect costs associated with the product. Cost accounting systems estimates the profitability of every item manufactured. It provide and important base to management of GSQ for decision-making. The costing methods are direct cost

Direct costing – In this costing systems only variables costs associated with the products are considered. Fixed costs are treated as period cost incurred during the period.

Standard costing – It refers to costing method in which actual output are compared with the budgeted output. Corrective measures are taken for reducing the variances.

Benefits

- It helps the management in implementing improved methods for reducing the cost.

- It aims at identifying the reasons of variances between the outputs.

- Cost accounting helps GSQ in deciding its profit margins based on the cost information derived.

Application

Cost accounting is applied by GSQ in the manufacturing processes for recording all the variable and fixed costs incurred for producing a product and keeping the costs under control.

Job Costing Systems

Job costing refers to the process of collecting informations related to costs which are associated with specific productions or the service job. The information helps in providing costing information to customers under contracts where cost is reimbursed. It is also referred as method where the costs the costs are compiled for work order or job (Granlund and Lukka, 2017).

Benefits

- It helps GSQ in identifying profitability of each job separately.

- Costs of similar jobs can be estimated on the information available from existing jobs.

- Detailed analysis of costs helps in taking cost control measures.

Application

It is applied in processes for identifying the cost of contractual specific products by GSQ. It provides detailed cost information for manufacturing product separately.

Integration with the organisational process.

The above management accounting systems are used by the GSQ for having proper management of the products or services produced by company. Integrating these systems with the production processes helps the company in managing the costs and keeping them under control to the extent possible.

Methods used in management accounting reporting.

The management accounting reports provide important information for taking strategic and operational decisions.

Budget Reports

Budget reports are prepared by the organisation before the start of the production process. These reports are the spending plans of company about the future activities and operations of company. It provides clear structure for the organisation to follow. The budget reports are prepared based on the previous budgets and information. Managers make adjustments related to inflations, demand and other factors in the current budgets. This helps GSQ in proper allocation of resources among various processes and activities.

Cost Accounting Reports

These reports cover all the information regarding the costs that are related with manufacturing of products or services. It contains detailed information about the all the items of costs separately. On the previous trends forecast about the future income and revenues are made and resources are allocated accordingly. They help the managers of GSQ in deciding the profit margin for each product. The information is very useful for decision making on the variances between the budgeted and actual results. On the basis of this reports strategic policies and procedures are taken.

Performance Reports

The performance reports contain the analysis of the performance of company and it operations. They provide the company whether the targeted level of performance has been achieved or not. If the performance targets are not achieved than company may take corrective measures for increasing the efficiency and productivity. These reports also assess the performance of individual and employees that helps company in rewarding them for future growth and success.

LO2

Different types of costing techniques used by GSK ltd.

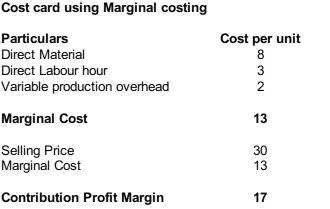

Marginal Costing

Marginal costing refers to the accounting technique where the amount at the given volumes of outputs by which the cost in aggregate could be changed if volume of outputs are decreased or increased by 1 unit. Marginal costing technique is used for identifying and evaluating the cost of product being manufactured within the organisation. This costing technique only considers the variable cost associated with the products. Fixed costs under marginal costing are treated as period cost and are not included in product cost.

Advantages

- The marginal costing is used in management decisions as comparison is possible.

- Linear relationship between variable cost and output may not be accurate.

Disadvantage

- Fixed costs are considered period costs.

- Company may face difficulty in segregation of cost between variable and fixd.

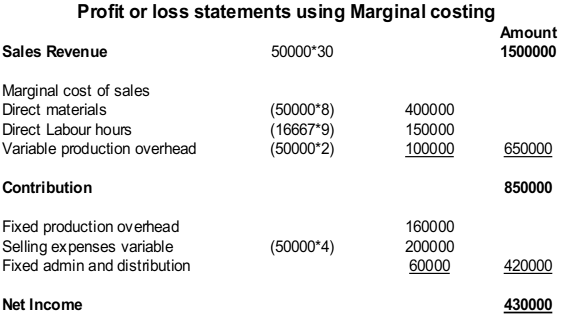

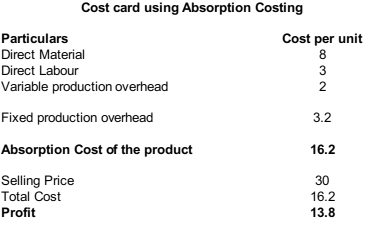

Absorption Costing

It is a costing method which is used by organisation for measuring the cost of products. It is also known as the full costing method. The costing methods accumulates all the cost associated with production process & apportion them to individual products. All the variable and fixed overhead are absorbed by the units produced. This costing method includes both variable and fixed manufacturing overhead in the product's cost.

Advantages

- The method considers both variable and fixed cost in product cost.

- The method is accepted by the accounting standards

- This provide more accurate and reliable information.

Disadvantage

- It is not useful for decision-making purposes.

- Comparison of two products cannot be made in this costing.

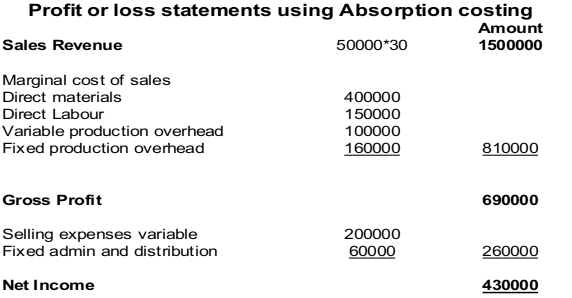

Report of costing under marginal and absorption costing

Marginal Costing -

Absorption Costing -

LO3

Different types of planning tools used in management accounting

Operational Budgets

It refers to he forecast about the expenses and revenue for single or more periods. Operational budgets are formulated typically by management of company prior to beginning of years. It provides the expected level of activities of business. It provides the management of GSQ a structured framework to be followed. They enable the company to keep the workforce and operations in right directions (Latan and et.al., 2018). On the basis of these budgets the manufacturing process is monitored with increased efficiency and reducing wastages and more effective utilisation of the available resources by company.

Advantages

The operational budgets helps the management of GSQ to keep the costs of operations within control. It helps the business to forecast about the future incomes and expenses on previous trends.

Disadvantages

The long range planning may be not accurate as they are based over the estimates. There are various factors that are not considered. Wrong forecasts can affect the operations of company.

Flexible Budget

It is defined as a budget which flexes or adjusts according to the changes in activities or volume of output. These budget are more useful and sophisticated than the static budgets. In static budgets amounts could not be changed. They remain same as they were when approved. Flexible budgets provide the scope for company to make required changes as required by the management. Business operates in a dynamic environments where the changes are required to be made for responding to these changes in the budgets. This become more easy for GSK to make adjustments without affecting the whole budgets and operations.

Advantages

Flexible budgets allow the company to make adjustments in the budgets for responding to the changes. It is more preferred by GSK in its management as it more easily adapts the financial needs of company. Requirements are reflected in budgets in advance.

Disadvantage

Changes in the budget may affect the management of resources. It makes difficult for the company to disagree with changes. Department makes the changes to budget on their own which may not be essential (Quattrone, 2016).

Cash Budgets

Cash budget is referred as the budget containing the information about the cash inflow and outflow. This budget contains information about the monetary funds. It represents where and how much cash is allocated to the activities. It ensures that sufficient funds are allocated to the departments and operations carrying out proper analysis of the budgets. These budgets enable the GSQ in identifying whether it will having sufficient funds for carrying out the operations or not. On the basis of this budget company makes necessary arrangements of the funds so that operations are not interrupted.

Advantages

Cash budgets helps company in proper allocation of funds among departments on the basis of its budgeted productions. This helps company to identify the requirements of monetary funds so that it can make available the required funds.

Disadvantage

If the budgets are not forecasted by making proper analysis of the past trends it can affect the business. Less estimates will lead to insufficiency of funds and higher estimates will be leading to finance cost.

LO4

Methods which organisation uses in management accounting for responding to the financial problems.

A business runs in a dynamic environment and it is not possible for the company to operate without adopting to the environment. Some of the issues can be controlled by the management like scarce resources, collection problems, insufficiency of resources and like issues. The management accounting methods can be used by GSK for adequately responding to these financial