Taxation Assignment Help | Leave Your Worries to Experienced Professionals

The study of taxation is a branch of financial study which includes different sorts of taxes and their respective laws. Many finance scholars define tax as “the compulsory financial charge that is imposed on the citizens in order to exercise the perks such as roads etc.” A university-level student has to take up different taxes as a subject of his assignment while pursuing a career in taxes and finance. Taxation assignment help has emerged in the market as a savior for all those students who have been struggling in completing their assignments. Taxation assignments can become hectic and troubling as one has to go through a lot of depth to understand the concepts and details about different tax forums, why these taxes are implied, on what basis are these taxes divided, etc.

If your taxation assignments are taking a toll on you and you are unable to sleep in the stress of “How to complete a taxation assignment?”, or you are wondering, “who can do my assignment on taxation?” then worry no more, Global Assignment Help is your one-stop destination for all your answers. Taxation is a very technical assignment that requires a writer to have sound knowledge of all the tax laws, taxation amendments, and different types of taxes their needs which is not a common skill set. Lucky for you, our experts are highly qualified academic writers who have in-depth experience in taxation assignment writing as well as know their taxation concepts at the back of their hands.

Now leave all your worries to our professionals and get good grades without breaking a sweat with our taxation assignment help.

What are the different types of taxes included in the curriculum by universities

There is a wide range of taxes that are included in the curriculum of different universities, which are needed to be understood and learned by the students in order to complete the task of taxation assignment writing. Your teacher can simply ask you to work on any tax for your assignment, but before that, you should be familiar with the most common types of taxes that are implied by governing bodies.

The taxes are majorly divided on the basis of 3 criteria:-

Tax On Earnings and profit- Every citizen of the state is expected to pay a little margin of their earnings as tax. Some of the taxes which fall under this category are-

- Income taxes - These are personal income taxes depending on the wages of an employee. These are progressive in nature, meaning as the earnings of a person increases, the amount of taxes they pay also increases. Usually, they are divided into price brackets according to the earning capacity. These taxes are used to pay for public services and provide goods to the public who are living below a particular income range. If a person is found to be a defaulter in paying his taxes, he is charged with strict tax evasion laws as tax evasion is a criminal offense in many countries.

- Corporate income taxes - These are similar to income tax, but they are applied to companies. You can understand it this way: if a person is earning a particular amount, they have to pay a certain part of it as an income tax. Similarly, a small chunk of accumulated profit of a company is required to be paid as corporate tax. According to our taxation assignment writers, corporate income tax and individual income tax function exactly the same way. Just like individual workers, companies are also divided into brackets based on their earning capacity, and different tax rates apply to different brackets.

- Pay-roll taxes - You might have heard salaried people talk about these taxes at the time of arrival of their salary; the payroll taxes are those taxes which are deducted from the salaries to provide different facilities to them such as social security and medicare. These taxes are mentioned in every month’s payslip and are collected on a monthly basis. A particular amount is decided to be deducted, and a part of it is paid by the employer.

- Capital gain taxes - any type of capital gain, i.e., profit in a particular asset, is subjected to capital gain taxes. The concept of capital gain is simple, suppose you bought a piece of land for amount X, and later you sold it for 2 times more than what you spent on it. This is called a capital gain. You spent X capital and got 2X in return. The profit you earned is subjected to a tax that you need to pay and is known as capital gains tax. Our experts can provide you taxation assignment help on any of the above topics.

Taxes On What You Buy - You might have seen price tags on goods that state “inclusive of all taxes,” this suggests that the amount you are paying has covered all the taxes that you are required to pay while buying a particular item.

- Sales Tax - It is a type of tax which is paid to the governing body when you sell particular goods. This tax falls under the category of consumption goods. Usually, these taxes are combined with the original cost price of a product, and then an MRP is generated so that when the consumer buys the product, they pay sales tax, and it does not affect the pocket of retailers. Though, many retailers and food chains still put their prices without the taxes and add up the tax at the time of purchase.

- Value-Added Taxes - Value-added taxes, more commonly known as VAT, is another type of consumption tax that is known as incremental in nature. It is called “incremental” Because this tax keeps on adding up after every stage of the production chain provided the previously paid VAT is deducted, the final consumer has to pay the entire VAT, which ensures that it remains a final consumption tax and tax pyramiding is avoided.

- Excise taxes - These taxes are imposed on particular goods, which are decided by the government. The excise tax is also considered to be a ‘Sin’ tax as it is applied on goods such as cigarettes, liquor, etc. The government can increase these excise taxes to reduce the consumption of such goods, which can cause harm to the citizens and consumers. They are the “extra premium” that a consumer pays on the consumption of such products and varies according to the jurisdiction of the government. Writing on such complicated topics require taxation assignment help

Taxes On The Things You Own - There are separate taxes that apply to things that you own. As a citizen, you have to pay taxes in order to become entitled to any sort of land or asset that you might have in your name.

- Property Taxes - Property taxes are taxes that directly levy on the property and real estate. When consumers buy any land, house, or shop, they have to pay a chunk of their investment as property taxes. These taxes vary from jurisdiction to jurisdiction and can be collected by any of the government bodies such as the national government, state government, or municipality.

- Estate And Inheritance Taxes - the estate and inheritance taxes are both applied on a property when the owner of the property is dead. The estate tax is paid by the state, and the inheritance tax is paid by the person who inherits the property. These taxes are also bundled together as “gift tax,” which is a necessity so that the land can be transferred to a person’s name prior to death.

These are the most common types of taxes that are seen across the globe. There might be some differences, depending on the jurisdiction and countries, but if you have knowledge about these taxes, you can easily understand other types of taxes that are derived from these. Students who are pursuing a career in finance and taxation need to go through a lot of detailed researches while working on one such task, and with such different types of taxes which have different applications and criteria, it becomes an impossible task for students to cope up with taxation assignment and they are left with no other option than looking for taxation assignment writing services.

What Are Some Important Topics Covered by Our Taxation Assignment Writers

The field of taxation is a really vast one, and there are numerous topics that can be used to write assignments on. According to our expert taxation assignment writer, every university has some specific tax types and tax-related topics on which they focus more. Our team of taxation assignment writers has been working in this field for a while now and provided taxation assignment help to lot of students on different topics.

Some of the topics which are considered to be the most highlighted ones in all the universities according to our taxation assignment writers are -

- Utilization of Tax Revenue - Your teacher can ask you to analyze and comment on how the tax is being utilized and what is your point of view on how the tax revenue should be utilized. Such assignments require you to carry out research on various tax-collecting government bodies and their policies of using the collected tax. Our Taxation Assignment Writing Service team is well-equipped with all the necessary statistics, and obtaining these states requires a whole lot of dedicated research and definitely, this process is time-consuming.

- Taxation on Interest & Dividend - Questions like “what are the policies for taxation on dividends?”, “Is a dividend treated as ordinary income?”, “what differentiates interests and dividends?” etc., fall under such assignments. Our taxation assignment writers suggest that while working on one such assignment, one must be familiar with tax policies on dividends and interest and how these are calculated, and what tax laws are implied on these transactions.

- Taxation on Small-Scale Business - “Small scale businesses are more prone to financial instability and implying huge taxes on them does nothing but makes their situation worse.” Your teacher can ask you to explain this scenario and suggest possible solutions for this as your next assignment. You need to have ample market knowledge and a sense of a small scale businessman to understand the situation and frame your assignment accordingly. These are also important tax laws that you need to memorize as they can also be asked in your final assessment. Most of the students seek taxation assignment help on related topics.

- Prospect of Value Added Tax - There are a lot of states in which VAT has been implied in a different way in different names. You could be asked to work on any of the case studies and comment on the problems and prospects of value-added taxes. One of the most common assignments on this pattern is “the case study of Enugu State.” Analyzing the case study, you are expected to present your own prospect as well as the problems of the particular case study and how you believe they can be solved. An eye for detail and critical thinking is the key to complete such assignments.

- Indirect Taxes - Understanding indirect taxes that a consumer pays is also as important as learning about direct taxes. Your taxation assignment can include a lot of questions about indirect taxes. The excise tax is the most common example of indirect taxes.

- Income Tax Evasion - One of the biggest felonies in almost every state of the world is tax evasion. What are the criteria for tax evasion? What are the laws that protect these taxes? What are the consequences of tax evasion, and what are the loopholes in tax evasion laws? Your taxation assignment could include any of the above questions, or maybe it can contain all of them. You must be prepared with all the numbers and figures to present your research.

- New Legislation in Taxation - the tax policies are always up for amendments and updates. According to our taxation assignment help expert, your assignment based on new legislation can include various developments and new policies on various taxes and taxation process in various states.

If you were looking for free taxation assignment topics, then you can use any of these topics, or if you already have an assignment on any of these which is due and you don’t know how to complete it under the deadline, there is no need to be stressed anymore, our experts have been working on these assignments for quite a while now, and you can ask them for taxation assignment help and leave your worries on their reliable shoulders.

What Makes Global Assignment Help The Best Taxation Assignment Writing Service, The Provider?

Taxation assignment writing is not easy, especially if you are unaware of all the concepts and laws. Students from across the globe, no matter from which university, face identical issues while working on a taxation topic. In our journey of providing students with reliable, trustworthy, and affordable taxation assignment writing services, we have been able to provide solutions to thousands of students. With a team of highly qualified experts and an unbeatable streak of happy clients, Global Assignment Help is the most successful assignment writing service on the internet today.

Qualities which make us the most demanded taxation assignment writing service are -

- 100 % Customer Retention - With our excellent taxation assignment help and on-point service mechanism, we have been able to retain 100% of our clients, which is a next to impossible thing to do, especially in the field of assignment writing.

- Ensured On-Time Delivery - We understand the importance of time and grades, and that is why we make sure that you get your desired assignment on your requested time no matter what the timeline is or what is the number of words to be written, if your order is accepted by us, it is surely going to get completed on time.

- Most Decorated Writing Service - Awarded with a lot many prestigious awards in the industry and loved by all of you, we are the most decorated assignment writing service, and it is all because of our expert taxation assignment writers who work day and night to simplify your lives and of course your support and mesmerizing reviews which serve as a fuel for our thriving journey.

- 100% Genuine Assignments - We believe it is better to not submit and fail than submitting a plagiarized assignment. Quality is the key that makes us unique. Our writers are professional field specialists who can uniquely provide taxation assignment help multiple times. So you get 100% plagiarism free and original documents.

- Flexible Customization Approach - What is the point of hiring someone if you have to work according to their specialization? None. That is why when you place your order at global assignment help, you are the boss. You direct us, and we take you to the destination. Every single detail of your assignment, the type of referencing you need, some special guidelines that you want to be followed so that you can give it your touch, everything is possible.

If you are still uncertain of why you should choose us, you can access free samples, and examples provided by our taxation assignment writers on our website and assess the quality of their writing.

No Added Taxes On Your Taxation Assignment Writing Help! | Order Your Assignment Now

That’s right.! You can order our taxation assignment help, and we promise not to charge you any extra taxes. All you get are quality documents, and premium discount offers to save some extra bucks. Order your assignment in just 3 steps, and let us handle all the worries.

To place an order all, you have to do is -

- Spell out your Specifications - Fill an order form and include every tiny detail about how you want your taxation assignment to be, and we will make it happen.

- Confirm your order - Complete your order by making the payment with our highly secure custom made payment gateways that ensure that your details are safe. Your privacy is our utmost concern

- Receive your order - Receive your custom-made taxation assignment help in the inbox of your registered email address with a free Plagiarism report.

Getting the best taxation assignment writing service has never been easier. Order now and avail a discount of 25% on your assignment. Get an additional 5% off on using our app to place the order. That makes it a total of 25+5 = 30%! What are you waiting for? Order now.!

- LATEST BLOGS -

By High Quality Assignment experts on university, academics, assignment, writing skills & tips, and many more

06 Aug 2024

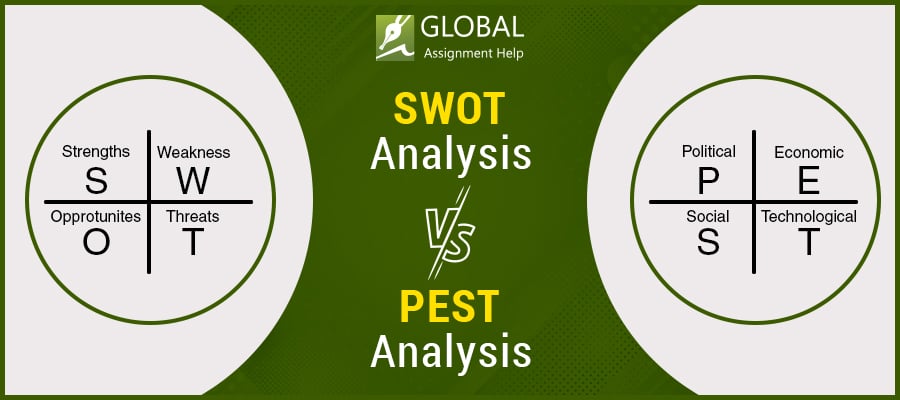

SWOT Analysis Vs. PEST Analysis: Want to Know What They Are?

Read More

05 Feb 2024

Driscoll Model of Reflection | What All You Need to Know?

Read More

29 Dec 2023

Write Excellent MBA Assignment for Better Grades

Read More

23 Dec 2023

Check Out 105+ Best Accounting Assignment Topics for Students

Read More

01 Nov 2023

An Excellent List of 100+ Geography Assignment Topics

Read More

20 Oct 2023

Learn About Slow and Fast Cycle Markets Strategy

Read More