INTRODUCTION

Finance is one of the essential elements which facilitate execution of the business strategies and policies in the right direction. Financial manager of an organization plays a vital role in making optimum utilization of the financial resources by framing cost effective strategies. The present report is based upon the different business scenario which will discuss the sources of finance which are available to the Sweet menu business organization. Besides this, it also depicts the implication and cost of the sources of finance which are undertaken by an organization to meet their financial need. Further, it will state the importance of the financial planning in achieving success in the dynamic business arena. In addition to this, this report will develop understanding about the calculation of the unit cost which plays an important role in making appropriate pricing decisions. This report will also shed light on the investment appraisal techniques which helps in making suitable investment decisions. Further, it represents the ratio analysis which helps organization in assessing the financial health and performance of an organization.

1.1 Identification of the sources of finance which are available to the Sweet menu in order to expand their business operations

There are several long and short term sources of finance which are available to Sweet menu restaurant. By using the appropriate source of finance Sweet menu restaurant can raise finance and there by become able to open the two new branches in Central London and Croydon. Long term sources of finance are those which provide financial assistance for the long period of time and include share capital, retained profit and bank loan. Whereas short term sources refers to leasing and hire purchase which helps organization in fulfilling their short term financial requirements. Sources of finance that firm can use are as follows.

- Share capital - Under this source of finance capital is arranged by issuing shares in the capital market (Akortsu and Abor, 2011). In this regard firm needs to pass certain criteria that are determined by the stock exchange. Only after passing these criteria firm can raise capital by listing its shares in the primary market.

- Bank loan - Under this Sweet menu restaurant raise a loan from the bank at a specific interest rate. This happens in case of fixed interest rate. In case of floating interest rate of finance cost is not determined. It is advisable to the firms that they must take a loan at the fixed interest rate instead of floating interest rate.

- Retained earnings - In case of this source of finance operations are financed from the internal sources. In this regard retained earnings are used which are a part of the earnings of the firm that remains after deducting all expenses from the cash flows.

- Hire purchase - This is a unique source of finance which is short term in nature. Under this arrangement an asset is taken on lease and rent is paid (Ha and Lee, 2011). If rent paid amount becomes equivalent to the purchase values then the asset is given to the lessee. Means that an asset is purchased by lessee from lesser by making payment in installment.

- Venture capital - Under this source of finance there is a company that gives a capital to the firm. In return it gets a shareholding in the company. Such company participates in day to day management meeting and gives guidance to the firm regarding its investment activity (Beddow and Cohen, 2003). Along with this it also charge sitting fee for giving a consultancy services.

- Debentures - It is a written acknowledgment of the debt taken by the firm from the general public. In return firm pay an interest to the debenture holders at a specific rate. As per law it is necessary for the firm to pay interest on debentures on a pre determined date. If default happen in same then debenture holders have a right to sue firm for nonpayment of interest or principle amount to them.

1.2 Implications of sources of finance

Following are the implications of sources of finance.

|

Sources of finance |

Advantages |

Disadvantages |

Legal |

Cost |

|

Shares |

Finance cost can be adjust as per company financial condition |

Issue of shares reduce control of existing shareholders on the company |

Needs to complete paper formalities with the regulatory authorities and under writers |

Dividend paid on shares is a finance cost |

|

Bankloan |

No dilution of control on the company. |

Finance cost can increase if loan is taken at the floating interest rate(Adams,2003). |

Needs to complete paper formalities with the banks. |

Interest paid on bank loan is a finance cost for the bank loan. |

|

Retained earnings |

No finance cost |

Non proper use of retained earnings increase opportunity cost for the firm. |

No legal implications. |

Opportunity cost is cost of this source of finance. |

|

Hire purchase |

Capital asset is acquired and paid in installment. Hence,firm bears less finance burden. |

By the time when firm made purchase technology may be obsolete. |

Need to sign a contract with lesser which is the owner of the capital asset. |

Rent paid to lesser is a cost of raising capital from this source of finance. |

|

Venture capital |

Finance cost is adjustable in nature |

Dilution of control on the company |

Require to sign contract with venture capital firm(JKirigiaandet.al.2008). |

Setting fee and return given to the venture capital firm is a cost of this source of finance. |

|

Debentures |

No dilution of control of the firm takes place in the firm |

Firm have to bear fixed finance burden. |

Require to follow rules and regulation determined by the regulatory authority. |

Interest paid on the debentures is a cost of this source of finance. |

1.3 Appropriate source of finance for Sweet menu restaurant

Sweet menu restaurant is small in size and due to this reason it is not able to raise money from equity, debentures and venture capital. Bank and retained earnings will be appropriate source of finance for the firm. In case of bank it will be best to raise capital at fixed interest rate. If loan will be raised at the floating interest rate. Then with change in interest rate by central bank finance cost of the firm may increase (Kung, Huang and Cheng, 2013). Hence, it will be better to use bank loan at fixed interest rate for financing company operations. On other hand, retained earnings are a second option that is available to the firm. In this firm will need to make sure that best possible use of retained earnings is done by the firm. There is no cost of raising capital from this source of finance. But if best use is not made then firm have to bear opportunity cost (Lindholm and Suomala, 2007). Opportunity cost is simply a benefit that company would receive if investment is made on other investment avenue. So, firms must make sure that retained earnings are used in the proper manner.

You may also like to read: Operations Management and Service Excellence

2.1 Cost of sources of finance

Following are the cost of sources of finance that are appropriate for the firm.

- Bank loan - It refers to the loan that is taken from the bank. Interest is paid on these loans at the fixed or floating interest rate. Both sorts of rates have some merits and demerits. As per situation, specific interest rate structure must be selected by the firm. When economy is unstable then loan at the flexible interest rate will certainly increase finance cost for the firm (Mohrman. and Shani, 2014). But in case of fixed interest rate finance cost does not changed even entire interest rate structure get changed in the economy.

- Retained earnings - It is a part of revenue that remains after paying all expenses. Due to this reason there is no finance cost on this source of finance. However, as per concepts opportunity cost is assumed as cost of this source of finance. It refers to the benefit that firm failed to receive due to non use of asset for other purpose (Northcott and Llewellyn, 2002). Firms must make sure that retained earnings are used in proper manner. So that they can reduce their dependence on the external source of finance.

2.2 Importance of financial planning

Financial planning refers to the way in which sources of finance from which funds will be raised is determined. Along with this the way in which these funds will be utilized is also determined in the budget. Sweet menu restaurant wants to open its two new restaurants in different areas of UK. For this it will need to make expenditures on building, land and other assets. In order to prepare a plan an aggregate estimate of investment will be made (Pacini, Qiu and Sinason, 2007). After that allocations of fund will be made in these activities. This will help in ensuring best use of funds for operations. Systematic allocation of funds will ensure that these funds will be used in efficient and effective manner. In other words, it can be said that financial planning helps in making best use of the available resources (Prakash, 2015). Hence, it can be said that financial planning has due importance for the company because it ensure best use available funds.

You may also like: Tour operation management sample

2.3 Assessment of the information needs of the different decision maker of Sweet menu

Information needs of different decision makers are as follows.

- Managers- These are those people that manage an organization in a legitimate manner. For this managers needs to prepare a strategy which will give a new direction to the company. Formulation of strategy needs overview of the business. For this financial statements are required and by analyzing financial statements they find out a direction in which company is going. On the basis of overview they formulate a strategy to give a strategic direction to the business (Roden and Dale, 2000).

- Creditors- These are those entities that give a debt to the company. Thus, they always want to know about the financial position of the company. They fulfill this requirement by using company financial statements like income statement, balance sheet and cash flow statement. On the basis of analysis of this statement they identify that a firm is in position to pay to its creditors or not. Hence, creditors give a due importance to the company financial statements.

- Government- It needs company financial statements in order to identify that a firm is paying an accurate amount of tax or not (Payne, 2006). By evaluating statements government ensure that a firm is paying proper amount of tax. Hence, financial statements have a great importance for the government.

2.4 Impact of the sources of finance upon the financial statements of Sweet menu which are undertaken by them to meet their financial needs

Loan of 5000 taken from bank

Table 1: Income statement of Sweet menu

|

Revenue |

350000 |

|

Less: cost of sales |

127500 |

|

Gross profit |

222500 |

|

Less |

|

|

Administration expenses |

92000 |

|

Selling and distribution expenses |

14500 |

|

Operating profit |

116000 |

|

Interest |

10000 |

|

PBT |

106000 |

|

Tax |

21000 |

|

Profit after tax |

85000 |

|

Proposed dividend |

80000 |

|

Retained earnings |

5000 |

Table 2: Balance sheet of Sweet menu

|

Non current assets |

|

|

Equipment |

75000 |

|

Deliveryvan |

52000 |

|

Furniture |

38000 |

|

165000 |

|

|

Current assets |

|

|

Inventories |

44000 |

|

Receivables |

13000 |

|

Cash and bank balance |

16000 |

|

73000 |

|

|

Current liabilities |

|

|

Payable |

38000 |

|

Net current assets |

35000 |

|

200000 |

|

|

Equity |

|

|

60,000 ordinary shares@1capital |

60000 |

|

Revenue reserves |

104000 |

|

Non current liability |

|

|

Long term loan |

36000 |

|

Net assets |

200000 |

Interpretation

Loan of 5000 taken and due to this reason amount of long term loan increases in the balance sheet. Along with increase in liability assets of the firm also increase under cash and bank balance head by 5000. In this way new source of finance affects financial statement of the firm.

3.1 Analysis of the budget and appropriate business decision based upon it

Table 3: Percentage change in budget elements

|

September |

October |

November |

December |

|

|

Cashsales |

15000 |

13000 |

15000 |

18000 |

|

Salaries |

7500 |

7500 |

8500 |

9000 |

|

Purchase |

3000 |

3000 |

3500 |

4000 |

|

Cashsales |

-13.33% |

15.38% |

20.00% |

|

|

Salaries |

0.00% |

13.33% |

5.88% |

|

|

Purchase |

0.00% |

16.67% |

14.29% |

Interpretation

From analysis of given and calculated table it can be seen that firm case sales are increasing continuously by good percentage and it growth rate is also increasing. On other hand, in the month of September and October salary was same nut in next two months due to increase in workforce salary also increase. In same way in case of purchase in the month of September and October purchase was same but in the month of November and December it grows rapidly. On other hand, sharp fluctuation is observed in the balance of the budget. It is continuously falling for two months and after that it increase and in the month of December it again fall. In first two months balance was negative because sales were falling in this time period. After that in November month sales increase and cash balance become positive. But at the ends, expenses elevate sharply and due to this reason again firm cash balance becomes negative even sales increase by 20%. Hence, it can be said that firm needs to make extra effort in order to control its expenses.

3.2 Calculation of the unit cost to determine the pricing of the product and services offered by Blue Island restaurant

|

Cost of meal |

10 |

|

Markup pricing |

40.00% |

|

VAT |

20.00% |

|

Cost of meal |

10 |

|

Markup pricing |

4 |

|

VAT |

2 |

|

Final price |

16 |

Unit Price = 16-4-2 = 10

Interpretation

On analysis of table it can be seen that final price of the meal is 16. When markup price and VAT charge is deducted from its unit price of the product comes in existence which is 10.

3.3 Assessing the viability of the project by taking into consideration the investment appraisal tools

Table 4: Calculation of payback period method

|

ProjectA |

ProjectB |

|||

|

Initial investment |

-1200 |

-1200 |

||

|

1 |

800 |

-400 |

300 |

-900 |

|

2 |

600 |

200 |

400 |

-500 |

|

3 |

400 |

600 |

500 |

0 |

|

4 |

200 |

800 |

600 |

600 |

|

5 |

50 |

850 |

550 |

1150 |

Interpretation

Pay back period indicate the time period with in which project can recover the investment amount. On analysis of table it can be seen that first project can recover investment amount in a year (Mohrman and Shani, 2014). Whereas, second project can recover investment amount in two years. Thus, it can be said that project A is more viable then B due to recovery of the invested amount in short duration.

Table 5: Calculation of NPV

|

ProjectA |

PV@10% |

Presentvalue |

ProjectB |

PV@10% |

Presentvalue |

|

|

Initial investment |

1200 |

1200 |

||||

|

1 |

800 |

0.909 |

727.2 |

300 |

0.909 |

272.7 |

|

2 |

600 |

0.826 |

495.6 |

400 |

0.826 |

330.4 |

|

3 |

400 |

0.751 |

300.4 |

500 |

0.751 |

375.5 |

|

4 |

200 |

0.683 |

136.6 |

600 |

0.683 |

409.8 |

|

5 |

50 |

0.62 |

31 |

550 |

0.62 |

341 |

|

Total |

1690.8 |

1729.4 |

||||

|

NPV |

490.8 |

529.4 |

Interpretation

NPV indicate the present value of the project after deducting initial investment value from the present value of the cash flows (Salvino, Tasto and Randolph, 2014). Both projects NPV is positive and in case of project B this value is higher than in case of project A. So, on the basis of results of this parameter it can be said that project B is viable then project A.

On comparison of both projects it can be said that project B is more viable then project this is because its NPV is higher than project A. However, pay back of this project is higher than project A. But NPV indicate the net present value which is assumed as most important parameter in project selection. On this criteria project B is perform well relative to project A. Thus, it can be said that project B is more viable then project A.

4.1 Discussing the essential or main elements of the financial statements

Main elements of the financial statements are as follows.

- Income statement- It is a statement that reflects the earnings and expenses that are incurred by the firm. By comparing this statement with previous statement manager can identify that company is performing well or not. This statement also indicates the proportion of each cost in revenue if financial modeling techniques are applied on the sales. On this basis projections of cost are made for the next financial year (Sedevich-Fons, 2014). Thus, this statement does not only tell about the firm performance. But it is also used to make projections related to the expenses.

- Balance sheet- It is a statement that indicate the financial position of the company. Ratio analysis is used to analyze balance sheet from various points of view. On the basis of results of ratios managers identify the areas in which company performs well and poor. Hence, managers get a direction in which they need to work.

- Cash flow statement- This statement indicate the inflow and outflow of the cash in the business. In order to identify these inflows cash flow statement is prepared. In this statement all activities are divided in to several parts like operating, investing and finance activity (Shaoul, Stafford and Stapleton, 2010). Cash inflows and outflows related to these activities are determined by the accountant. After this cash flow statement is prepared in which current year profit is taken for calculation. By doing calculation cash and cash equivalents available at the end of the year are identified. Hence, in this firm comes to know about the actual cash that remains in its hand at the end of the year.

4.2 Comparing the formats of financial statements for the different types of business organization

Sole trader

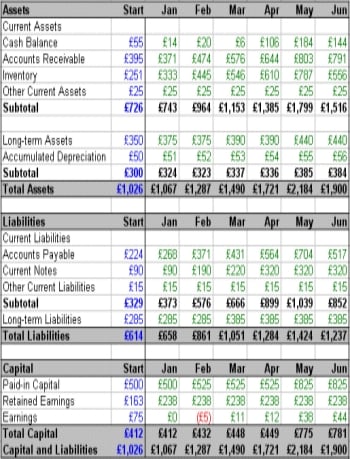

Illustration 1 : Balance Sheet of Sole Trader

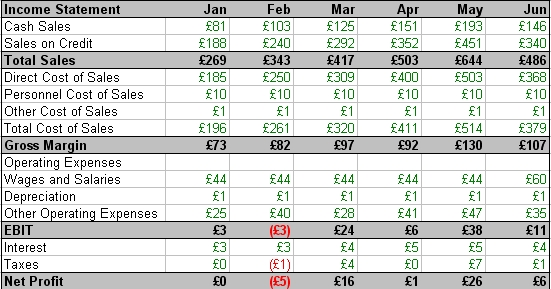

Illustration 2 : Income Statement for Sole Trader

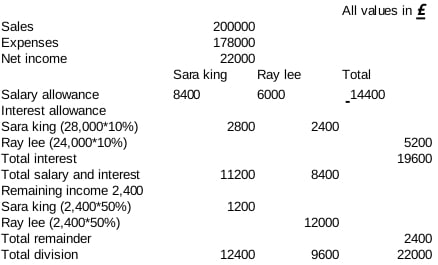

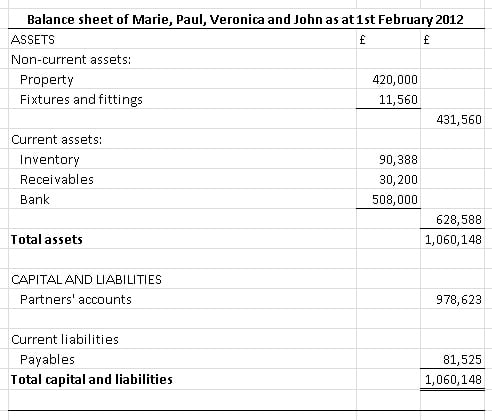

Partnership

Illustration 3 : Income Statement for Partnership

Illustration 4 : Balance Sheet for Partnership

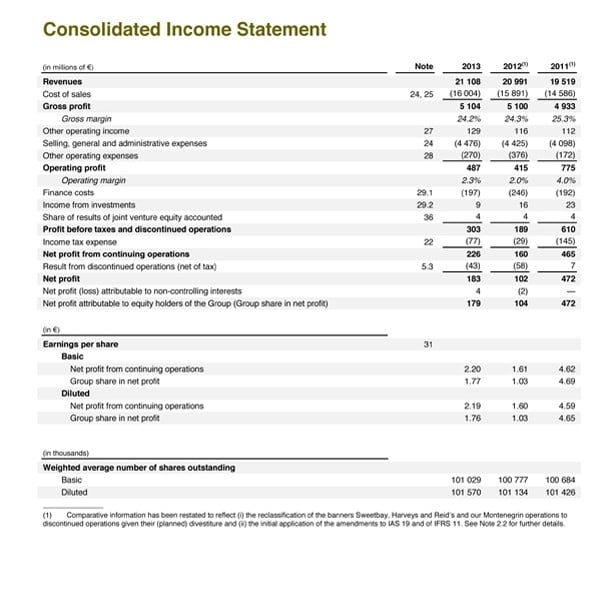

Company

Illustration 5 : Company Balance Sheet

Illustration 6 : Income Statement of Company

There is a similarity in the financial statements of all business firms. Due to difference in

business size items in these financial statements are different from each other (Siano Kitchen and Confetto, 2010). Otherwise there is a slight difference in the format of these financial statements.

4.3 Interpretation of the financial statements by making analysis of the ratios of both the restaurants

Table 6: Ratio analysis

|

SMR |

BIR |

|

|

Gross profit |

222500 |

198000 |

|

Net sales |

350000 |

299000 |

|

Gross profit ratio |

0.6357142857 |

0.6622073579 |

|

Net profit |

85000 |

94800 |

|

Net sales |

350000 |

299000 |

|

Net profit ratio |

0.2428571429 |

0.3170568562 |

|

Current assets |

68000 |

41000 |

|

Current liability |

195000 |

123000 |

|

Current ratio |

0.3487179487 |

0.3333333333 |

|

Liquid assets |

24000 |

10000 |

|

Current liability |

195000 |

123000 |

|

Quick ratio |

0.1230769231 |

0.081300813 |

|

Sales |

350000 |

299000 |

|

Stock |

44000 |

31000 |

|

Stock turn over ratio |

0.1257142857 |

0.1036789298 |

|

Debt |

31000 |

5000 |

|

Equity |

164000 |

118000 |

|

Debt equity ratio |

0.1890243902 |

0.0423728814 |

|

Debt |

31000 |

5000 |

|

Assets |

233000 |

188000 |

|

Debt to assets ratio |

0.1330472103 |

0.0265957447 |

Interpretation

- Gross profit ratio- Gross profit ratio indicates the percentage of sales that is covered by the gross profit (Beaupert, et.al, 2014). In case of SMR gross profit ratio is 63.57%. Whereas, value of same ratio in case of BIR is 66.22%. Hence, it can be said that BIR gross profit ratio is very high. This ratio also reflects the firm ability to control direct cost. Performance on this ratio indicates that BIR has a good control on direct expenses then SMR. Hence, it can be said that management of BIR is better than SMR.

- Net profit ratio- Net profit ratio indicates the percentage of sales that is covered by the net profit. In case of SMR net profit ratio is 63.57%. Whereas, value of same ratio in case of BIR is 66.22%. Hence, it can be said that BIR net profit ratio is very high. This ratio also reflects the firm ability to control indirect cost. Performance on this ratio indicates that BIR has a good control on indirect expenses then SMR. Hence, it can be said that management of BIR is better than SMR.

- Current ratio- Current ratio indicates the firm ability to pay current liabilities by using current assets (Towill, 2009). This ratio indicates the amount the amount of current assets that is available to pay each unit of current liability. Current ratio in case of SMR is 0.38 whereas same in case of BIR is 0.33. This reflects that SMR liquidity position is better than BIR. For every one pound of liability SMR has 0.38 cent of current assets. Whereas, in case of BIR for every one pound of current liability there is a 0.33 cent of current asset. Hence, it can be said that SMR is in better position than BIR. But if we compare both companies performance with the standard then it can be said that both firms performance is poor. Their current ratio is below standard one.

On other side, on analysis of figures it can be seen that in case of downturn in the economy both firms will not be in position to pay their current liabilities using current assets. Even they will not be in position to pay fifty percent of their current liabilities using current assets.

- Quick ratio- In case of quick ratio also same condition is repeated and this happens because in calculation of quick ratio inventory is excluded from current assets (Wagar and Rondeau, 2000). In case of this ratio condition is worse and if stock is excluded then firm is not at all to pay current liabilities using quick assets. Hence, it can be said that both firms needs to take steps in order it improve their liquidity position.

- Stock turnover ratio- This ratio indicate the number of times the stock is turned over to generate sales. In case of SMR stock is turned more times than BIR. Hence, it can be said that SMR IS performing well in comparison to BIR.

- Debt to equity ratio- This ratio indicates the company capital structure (Sedevichâ€Fons, L. 2013). Debt equity ratio of the SMR is 0.18. Whereas same of BIR is 0.04. Proportion of debt is very high in case if SMR. Hence, it can be said that BIR is in better position than SMR.

- Debt to assets ratio- Debt to asset ratio indicates the proportion of debt relative to assets. In case of SMR this ratio is very high. Whereas in case of BIR this ratio is very low. Hence, it can be said that BIR is in better position than SMR.

Read Also:

- Management of hospitality services hilton hotel

- Management Accounting Report - Tech UK Limited

- Understanding Change Management | Toyota

CONCLUSION

On the basis of above discussion it is concluded that firms must carefully select a source of finance. These sources must be select with due care. Company liquidity position and fundamentals must be considered before selecting any specific source of finance. In this report, project evaluation techniques are also applied and best project for the company is selected by the analyst. It is advisable that merely by looking cash flows any project must not be selected by the analysts. Managers must apply ratio analysis technique in order to evaluate company performance from various angels. This will help firm in preparing business strategy on time.

REFERENCES

Books & journals

- Adams, S., 2003. Healthy homes, healthier lives: Linking health, housing and social care services for older people. Housing, Care and Support.

- Akortsu, A. M. And Abor, A. P., 2011. Financing public healthcare institutions in Ghana. Journal of Health Organization and Management.

- Beddow, T. and Cohen, D., 2003. Allocating health (and social care) expenditure in Wales. Interrnational Journal of Public Management,.

- Ha, S. and Lee, J. Y., 2011. Determinants of consumerâ€driven healthcare: Selfâ€confidence in information search, health literacy, and trust in information sources. International Journal of Pharmaceutical and Healthcare Marketing.

- JKirigia, M. J. and et.al., 2008. A comparative assessment of performance and productivity of health centres in Seychelles. International Journal of Productivity and Performance Management.