Question :

Questions- This assessment will cover the following questions:

- Analysing whether a traditional budgetary system is appropriate in the Vision Plc or not.

- Provide understanding of the following budget methods: rolling budgets, zero based budgets and activity-based budgets. Explain how each method attempts to improve on the traditional approach.

- Vision Plc is a IT service company. Explain the purpose of preparing budget and the process of the organisation needs to follow.

Answer :

PART 1

i) Purpose of preparing budget, its process and how budget could help in development of business

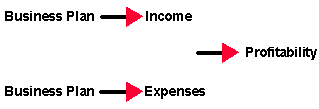

Budgets are the most important and essential part of any company whether operating on larger or smaller scale. This comprises of forecasting of income and expenses for firm in way of decision making process including all type of expenditure which company need to make. The main purpose of preparing budgets is allowing firm to create all type of spending plan for the available funds with company (Fu, 2015). This will also ensure that company is having enough amount of money in spending on each of the things which are important. The Vision Mix Plc. is using traditional method of budgeting but it was also included that this approach is not good for company to manage their next year process of budget as well.

Budgeting is the most important process for company which will be having effects on forecasting, income, expenditure and is proper tool for decision making which help in managing and monitoring business performance. So the following is been included to as purpose of budgeting:

Forecasting of income and expenditure- This is the most important purpose of forecasting which is termed to as expecting or determining income and then expenditure for company. It is very much important for firm that they are predicting the need and want of people or customers so that they could be able to make profit.

Tool for decision making- This is another purpose of the preparation of budgets which includes providing framework for the decision making. The course of action to be included within purpose so that course of action to be having planned out.

Monitoring business performance- This would be regarded to as last purpose of monitoring business performance which could be deciding over monitoring performance of business especially that of actual budgets.

ii) Application of traditional budgeting approach with example for business budgeting

Incremental budget- This type of budget is prepared by using the previous year budget or the actual performance of basis within incremental amounts added into the new performance. This is called to as the forecasting process which includes the actual result comparison with its expectation one so that next year budget could be determined. One of the biggest disadvantages of this type of budgets is its inefficiency as it will be consuming too much time and resources of management.

Top-down- In this type of budget senior level managers of company will be taking steps for setting out goals of budget and then this will be imposed on others for taking as goals for Vision Mix Plc (WEI, KIRSCH and KERNOHAN, 2016). the disadvantage is that only senior level will be included within this type of budget formulation while it would then be imposed on others. While this is not that much time consuming as only certain type of people will be planning out for the formulation of this budget.

Fixed budget- This is type of budget which is prepared for specified period of time which is usually called to as fiscal or financial year. The major disadvantage could be that related to its low change responsiveness which means that there will be no reviewing it for longer duration of time. While as it is prepared for one year only so there will be no need to review it for at least a year period which is regarded to as positive point for it.

iii) Appropriateness of traditional budgetary system for part of business

There are many alternatives for these traditional budgetary system that company could use for its planning and formulating of budgets over specified period of time. As it could also be included that all type of traditional budgeting methods will be having its own alternative and it is not necessary that they are been used for all parts of company. These traditional approaches to budgeting will be having most important role to be followed within the respect of company which will allow firm to provide its framework over controlling and regulating of rules (Gay, Schultz and Braun, 2018). It is necessary at all the time that traditional budgetary system could be used for all department of Vision Mix Plc.

There are many advantage of these traditional budgeting approach like it help Vision Mix Plc. to provide the framework for controlling of funds in and out flow from company. This is also included to as organisational cultural as it is most essential part of departments of company. Thus, it may be a risky decision to abolish this fundamental method of operating as suggested within the budgeting concept. The process of traditional budgeting will also be having accommodation in need with decentralising as most of the functions and system of company need to be decentralised by senior level managers. Vision Mix Plc. could use this traditional set of budgeting as they will be using or putting coordination of budget assumption across all type of departments.

Rolling budget- Vision Mix Plc. could be using this type of budgeting technique which helps them to continuously improve the actual budget based on changes which could be taking place on each month.

Flexible budget- Vision Mix Plc. will also be using this type of budgeting technique which includes the revenue and cost generating over specified period of time so that budget could be prepared.

PART 2

iv) Alternative budget methods

There are many alternative type of budgeting which Vision Mix Plc. should be using apart from the traditional one which would be most helpful for company in formulating periodic budgets. As it could include that Vision Mix Plc. (Rognoni, Sommariva and Tarricone, 2016). is using traditional budgeting system and its Finance Director did not think that it is most appropriate for company as there are many types of changes which could be impacting business of Vision Mix Plc. It was also included that if there is any sort of change within the approach of budget then this should be made in coming next year only so that it could be significantly making out changes. There could be included certain alternative budgeting methods which are suggested for Vision Mix Plc. so that they could be lowering down the impact of not using any sort of default.

Rolling budget-

This is that type of budget which is based on continuously updating within the time frame for remaining stable with the actual period so that budget could be having certain amount of changes within period of 1year. Thus this type of budget would be including incremental extension of the existing budgeting model in way of doing the business and extending it for over one year. It would also be having certain advantages and disadvantages over specified period of time like it is reflecting dynamic nature of business environment. This is the advantage of rolling budgets which includes that it would be recognising all type of anticipated difficulties over period. While the disadvantage include that it is very much time consuming preparation of budget which means that managers would be spending too much time in preparation of every time fresh forecast.

The rolling budget, in effect, starts the year all over again. The budget variances year to date are deleted like a fresh start (Vargas and Espinoza, 2016). But this can be a disadvantage, because some companies find that no matter how many times they re-forecast, they still experience unacceptable budget variances. The problem could be their forecasting methods.

ZBB-

Under this type of budget includes the process from the ground to upper level which means that this budget would be prepared every time for the first time only. This is the reason as to why it is called to as Zero-Based budgeting as the budgets which is prepared under this is starting from value of zero and nothing from last year could be includes into this current year.

One of the major merit of this budgeting system is this is very much flexible budget and only focus on operations of business over the lower down cost. Against the regular methods of budgeting that involve just making some arbitrary changes to the previous year’s budget, zero-based budgeting makes every department relook each and every item of the cash flow and compute their operation costs. This helps in efficient allocation of resources (department-wise) as it does not look at the historical numbers but looks at the actual numbers. Budget inflation: Since every line item is to be justified, zero-based budget overcomes the weakness of incremental budgeting of budget inflation. Zero-based budgeting is a very time-intensive exercise for a company or a government-funded entities to do every year as against incremental budgeting, which is a far easier method. Making an entire budget from the scratch may require the involvement of a large number of employees (Baxter, 2017). Many departments may not have an adequate time and human resource for the same.

While the demerit is that it is having complete possibility for getting manipulated by the managers of company and it will also be biased based on short term planning. Zero-based budgeting aims at reflecting true expenses to be incurred by a department or a state in the case of budget making by the government. Although time-consuming, this is a more appropriate way of budgeting. At the end of the day, it is a company’s call as whether it wants to invest time and manpower in the budgeting exercise to provide more accurate numbers or go for an easier method of incremental budgeting.

ABB-

This is also called to as activity based budgeting which divides the budget of all departments in way of recording, researching and analysing all expenses based on activities and the cost which they are incurring. This will be generally included to as adjusting the previous budgets and accounting for inflation or business development as well. This type of budgeting is majority used by companies which are new and small as they could only define each activities that are driving the business and need to be included within the use of cost drivers.

The advantage of this type of budgeting method is that it allows more control over budgeting process with including revenue and expense of planning occurring with precise with providing useful information. Whereas disadvantage is that it is very much costlier that all traditional budgeting technique where it could be requiring more information.

It could be concluded that Vision Mix Plc. could be using any type of budgeting method for incorporating the changes within the budgeting system that is related to company. ABB, ZBB and rolling budget could be used by company so thhat it could help them in evaluating results and budgeting system as well.

v). Application of different budgeting approaches in an organisation

Alternative method of budgeting is more effective of Vision Mix Plc. in comparison of traditional budgeting method because the tool support management of day to day activities. Like implication of incremental budgeting which is traditional budgeting approach can be risky for the business because in this Vision Mix Plc. will be focused on making assumption over changes with regard to current business performance.

However, there is zero based budgeting approach which helps company in focusing on specific activities and things which are essential for the business to be managed. In this the finance team of organisation aim at making assumption by double checking the need of change and improvement in particular area (Ekanem, 2014). It is effective for manufacturing firm because it enables flexible approach of managing changes which assist in managing cost effectiveness in services.

Apart from this, there is activity based budgeting method enables transparency in budget process in which the company is able to directly allocate budget according to different activities. Vision PLC is a manufacturing firm where it is essential for the organisation to set and plan budget according to activities (Activity-Based Budgeting (ABB), 2013). When implementing ABB it is important to have critical understanding over all the activities of organisation. The process is for short-term and enables huge cost investment. Apparently, it can be argued that ABB is beneficial to be implemented in Vision Mix Plc. because it is based on evaluation of each and every activity. Further, the approach will assist the business in attaining competitive advantage by eliminating the chances of bottle necks. In this budget is set by considering business as one unit which helps in determining relevant cost involved in every activity. Thus, it can be said that implication of AB budgeting approach in manufacturing firm will assist the company in improving relationship of functional unit of Vision Mix Plc.

Best Dissertation Writing Service Online to Take the Load Off Your Mind

vi) Analysing one of the method which is appropriate for Vision Mix Plc.

It could be included that ABB budgeting approach is the best suited for Vision Mix Plc. as this could be helping in evaluating all type of activities which company is having so that they could be able to understand how they are managing their work. Other than this Vision Mix Plc. could also use ZBB which is having another best approach used by company in which they are not using or having any kind of amount left from last year’s budget (Baxter, 2017). As the ABB will be allowing more control over the budgeting process planning out all revenue and expense within the planning process was including and providing useful data regarding all type of projection.

Thus ABB will also be management to having its increment control over the budgeting process and aligning with the budgeting with having overall goal of company. While it is also very much costlier as compared to others like that of traditional so Vision Mix Plc. should be considering both the positive and negative side of approaches. ZBB is that under which all type of activities are considered to as not having use of other funds or resources which are required by department. These both methods could be used by company so that their budgeting could be appropriate for the Vision Mix Plc.

You may also like to read:-

Importance of Innovation and its Types- McDonald's

REFERENCE

Books and Journals:

Baxter, G., 2017. Mock Me! A guide to developing a first rate training tool on a second rate budget. Journal of the Georgia Public Health Association.

Ekanem, E.E., 2014. Zero-based budgeting as a management tool for effective university budget implementation in University of Calabar, Nigeria. European Journal of Business and Social Sciences. 2(11). pp.11-19.

Also look out:- Marketing Methods for Reaching out Potential Customers