Question :

This assessment will cover following questions:

- Alpha Ltd. Produces stones, cement and paper sacks. Generate an understanding of management accounting systems.

- Implement a range of management accounting techniques and methods.

- What is the use of planning tools which is used in management accounting.

- Compare ways in which Alpha Ltd. could use management accounting to respond to financial problems.

Answer :

INTRODUCTION

Management accounting is a concept of analysing the internal financial and non financial information of an organisation in order to make relevant decisions for the growth and development of the organisation (Almaktoom, 2017). This concept is an area of study which facilitate management accountants to analyse the information by which they can enhance profitability of the organisation (Carlsson-Wall, Kraus and Messner, 2016). The main aim of this report is to develop understanding about the concepts and systems of management accounting. In this report, a medium sized organisation is selected which is Alpha Ltd. This is a medium sized manufacturing organisation which manufacturers local pizza. This organisation has 50 staff members and annual turnover of £500000.

In this report, the concept of management accounting is explained in detail along with the description and application of its systems in context of Alpha Ltd. Besides this, various management accounting reporting methods are evaluated along with its integration with system within the organisation. Management accounting techniques such as marginal costing, absorption costing and CVP analysis are used to develop income statements for Alpha Ltd. In the second part of this report, various budgetary tools are assessed along with their advantages and disadvantages. In the last, a comparative analysis is used to compare the ways by which management accounting techniques can be adopted.

TASK 1

P1 Explaining management accounting and essential requirements of its systems

Management accounting is a procedure of presenting the financial information using management accounting techniques so they can be used by management accountants to make reliable decisions for an organisation. This accounting concept involves recording to the transactions of regular course of an organisation. This accounting procedure is collection of various techniques and methods which require special knowledge and ability which ultimately aims of enhance profit making ability of an organisation (Chenhall and Moers, 2015). Alpha Ltd. is a medium scale organisation which manufacturers and then sell local pizza. The operations of this organisation includes day to day activities due to which it is important for this organisation to consider appropriate usage of management accounting techniques so that growth and development of this organisation can be ensured. Apart from financial accounting, it is important for Alpha Ltd. to use management accounting as well because of these accounting procedures are way different from each other.

Financial accounting is used for the purpose to serve external and internal stakeholders but on the contrary management accounting can only be used by internal stakeholders such as managers and board of directors. Management accounting is not regulated by any law due to which skill requirement in the course of preparing management reports is less than financial reports. Also the management accounting report does not need to be audited which even makes it more important for Alpha Ltd. as they do not have to bear expense of auditor (Jamil and et.al., 2015).

Alpha Ltd. is at its developing stage where they must consider using management accounting systems so that they can effectively utilise their earnings. Management accounting systems are the basis which assist in managing different variables of an organisation. There are various types of management accounting systems which are discussed below along with their essential requirement in context of Alpha Ltd.:

Cost accounting system

This management accounting system is used to estimate the cost which will be incurred by an organisation. This provides a framework by which an organisation can estimate the cost for the products manufactured by them which is further used for the purpose of cost control. There are broadly two types of cost accounting system i.e., process costing and job order costing. In the case of process costing, an organisation estimates the cost which can be incurred by completing their whole manufacturing process. On the other hand, job order costing includes estimation of cost of each job order. In context of Alpha Ltd. both of these cost accounting techniques are used by which they predict cost expense in their manufacturing process and cost expense of special pizza orders which they get. These techniques help them to first estimate their incurred cost and then control that cost by using measures of economies of scale and optimum utilisation of resources (Jukic and Hedi, 2014).

Inventory management system

In this management accounting system, an organisation develops a framework in which they record all the transactions of ordering and storing the inventory. This inventory includes raw material, semi finished goods and even finished goods. The aim behind sing this system is to optimally use the available inventory. There are various techniques by which an organisation can use manage their inventory. These techniques are FIFO, LIFO etc.

FIFO is a technique in which organisations first uses the inventory which is first bought by them and in case of LIFO, organisation first uses the inventory which is last bought by them (Kaplan and Atkinson, 2015). Alpha Ltd. is a pizza manufacturing company which develops their products using raw material which is perishable in nature due to which they must use FIFO method by which their raw material will be fully utilised and wastage will be minimised. These are the essential requirements of this system for Alpha Ltd. due to which they must more emphasise in effectively using management accounting and its systems.

Price optimisation system

This management accounting system is the based on mathematical and economic equations which helps in analysing the demand for the products at various price levels. The aim of using this system is to set optimised prices for products which can help in raising the demand and profitability. In context of Alpha Ltd. which is a pizza manufacturing company must use this management accounting system which is essentially required by them as by this, they can set flexible prices for their produced pizzas which will increase the demand and as well organisation’s profitability.

P2 Explaining different methods of management accounting reporting

Management accounting reporting is a process of creating various reports which helps an organisation to present financial information in an effective way so that profitable decision can be made. Methods of management accounting reporting includes various reports which are developed by management accountants to record day to day activities of an organisation. These management accounting reports or reporting methods are discussed below:

Budgetary report

A budget report is a record of estimated costs which an organisation estimates to plan their expenses. This report includes prediction of future costs and revenues which can occur within an organisation. The basic objective behind developing this report is to predict contingencies which can be seen in future period so that provisions for those contingencies can be developed and a prevention action plan can be prepared. Alpha Ltd. can prepare this report in which they can list all future revenues and expenses which expect to be occurred. By this, they can be prepared for future contingencies which might suffer their operations.

Account Receivable Aging Report

According to this management accounting reporting method, every organisation must develop a report which records all the transactions which are done on credit and organisation is entitle to receive an amount (Karadag, 2015). The main aim behind developing this report is to keep the track of the values which company is entitled to receive from its creditors. Using this report, an organisation can also identify the defaulters and make suitable legal actions. Alpha Ltd. is a medium scale organisation which manufactures and sells pizzas to local public. The credit transactions of this organisation are comparatively less and this organisation does not heavily rely upon extending credit. But in order to identify the defaulters, it is important for Alpha Ltd. to use this reporting method and develop a report which can transact each and every transaction which is done by providing or extending credit to their customers.

Performance report

It is one of the most influential reports which helps an organisation to improve overall performance of the employees and the processes of an organisation. In this report, continuous performance of each and every employee of an organisation is first recorded and then analysed by comparing it to benchmarks. This report enables to review contribution of each employee against fulfilment of the organisational objectives. In context of Alpha ltd., human resource manager can analyse the performance of the employees of this organisation and then communicate that information with management accountants so that they can record that information in an understandable form and then continuously review their performance in order to make sure their full potential to enhance productivity of the organisation.

Cost management report

This management accounting report is one of the most basic report which helps an organisation to records all the costs which are incurred by them for producing their products. The main aim of developing this report is to record all the cost transactions so that expense and spending limit of an organisation can be managed and controlled. Alpha Ltd. can use this report to analyse their cost expenses which are incurred by them regularly and then at the end of the month they can compare their cost report which budgetary report to identify the variance.

All the above reports are usually developed by management accountants and are presented effectively so that management decisions can be made. It is important for organisations like Alpha Ltd. to develop these reports and present their managerial accounting information in them to assist stakeholders such as management and employees. Management and employees are the internal stakeholders of an organisation which can analyse the true financial position of an organisation using above mentioned reports and can make effective and suitable decisions so that they can ensure organisation’s productivity and profitability.

M1 Benefits of management accounting systems and their application

|

Management accounting system |

Benefits |

Application in context of Alpha Ltd. |

|

Cost management system |

This system facilitates in controlling the cost so that overall expenses of an organisation can be reduced and profits can be increased. |

Alpha Ltd. can use this system to identify the cost incurred by them in producing each pizza order and then can analyse the ways by which that cost expenses can be reduced. |

|

Inventory management system |

This system helps in managing the inventory from which cost of those materials reduces and revenues increases. |

Alpha Ltd. can apply FIFO technique of this system by which they can use their pizza producing inventories effectively which will not be damaged despite of their perishable nature. |

|

Price optimisation system |

This system is advantageous as an organisation can set effective prices of their products which can increase demand of their products (Maskell, Baggaley and Grasso, 2017). |

Alpha Ltd. can select a reliable pricing strategy for their products using this system so that the demand for their pizzas can even enhanced. |

D1 Critically evaluating integration of management accounting systems and reporting within organisation

Management accounting systems and reports are together integrated within an organisational process which impacts both in positive and negative way. This can be understood using an example of cost accounting system and cost management report in the process of manufacturing of Alpha Ltd.

Management accountants first use the management accounting system to identify all the cost incurred by manufacturing unit of Alpha Ltd in producing pizzas for all the orders. After this, they use management accounting report to record all these costs in a presentable way. By this, Alpha Ltd. can control their spending level. But by this, much time and money of the organisation’s employees will be utilised.

TASK 2

P3 Preparing income statement using marginal and absorption costs

Problem 1:

Variable Costing System

Unit product cost

|

Marginal Costing Statement calculator |

|

|

Unit Selling Price |

8 |

|

Unit Variable Cost |

3 |

|

Fixed Manufacturing Expenses |

150 |

|

Non Manufacturing Expenses |

50 |

|

Budgeted Activity |

75 |

Income Statements

|

Period |

Apr-19 |

May-19 |

Jun-19 |

Jul-19 |

Aug-19 |

Sep-19 |

|

Sales |

600 |

480 |

720 |

600 |

560 |

640 |

|

Opening inventory |

0 |

0 |

45 |

0 |

0 |

45 |

|

Add: Variable Cost [Production] |

225 |

225 |

225 |

225 |

255 |

210 |

|

Less: Closing Inventory |

0 |

45 |

0 |

0 |

45 |

15 |

|

Marginal Cost of Sales |

225 |

180 |

270 |

225 |

210 |

240 |

|

Contribution Margin |

375 |

300 |

450 |

375 |

350 |

400 |

|

Less: Fixed Manufacturing Cost |

150 |

150 |

150 |

150 |

150 |

150 |

|

Less: Non Manufacturing Cost |

50 |

50 |

50 |

50 |

50 |

50 |

|

Net Profits |

175 |

100 |

250 |

175 |

150 |

200 |

Working notes

|

Period |

Apr-19 |

May-19 |

Jun-19 |

Jul-19 |

Aug-19 |

Sep-19 |

|

Sales |

75 |

60 |

90 |

75 |

70 |

80 |

|

Production |

75 |

75 |

75 |

75 |

85 |

70 |

|

Opening inventory |

0 |

0 |

15 |

0 |

0 |

15 |

|

Closing inventory |

0 |

15 |

0 |

0 |

15 |

5 |

Absorption costing system

Unit product cost

|

Absorption Costing Statement calculator |

|

|

Unit Selling Price |

8 |

|

Unit Cost (FC+VC) |

5 |

|

Fixed Manufacturing Expenses |

150 |

|

Non Manufacturing Expenses |

50 |

|

Budgeted Activity |

75 |

Income Statements

|

Period |

Apr-19 |

May-19 |

Jun-19 |

Jul-19 |

Aug-19 |

Sep-19 |

|

Sales |

600 |

480 |

720 |

600 |

560 |

640 |

|

Opening inventory |

0 |

0 |

75 |

0 |

0 |

75 |

|

Add: Variable Cost [Production] |

375 |

375 |

375 |

375 |

425 |

350 |

|

Less: Closing Inventory |

0 |

75 |

0 |

0 |

75 |

25 |

|

Marginal Cost of Sales |

375 |

300 |

450 |

375 |

350 |

400 |

|

Gross Profit |

225 |

180 |

270 |

225 |

210 |

240 |

|

Adjustment for Overheads |

0 |

0 |

0 |

0 |

-20 |

10 |

|

Less: Non Manufacturing Cost |

50 |

50 |

50 |

50 |

50 |

50 |

|

Net Profits |

175 |

130 |

220 |

175 |

180 |

180 |

Working notes

|

Period |

Apr-19 |

May-19 |

Jun-19 |

Jul-19 |

Aug-19 |

Sep-19 |

|

Sales |

75 |

60 |

90 |

75 |

70 |

80 |

|

Production |

75 |

75 |

75 |

75 |

85 |

70 |

|

Opening inventory |

0 |

0 |

15 |

0 |

0 |

15 |

|

Closing inventory |

0 |

15 |

0 |

0 |

15 |

5 |

Schedule of reconciliation

|

Period |

Apr-19 |

May-19 |

Jun-19 |

Jul-19 |

Aug-19 |

Sep-19 |

|

Net Profits under Absorption Costing |

175 |

130 |

220 |

175 |

180 |

180 |

|

ADD : Fixed Overheads in opening |

0 |

0 |

30 |

0 |

0 |

30 |

|

LESS: Fixed Overheads in closing |

0 |

30 |

0 |

0 |

30 |

10 |

|

Net Profits under Marginal Costing |

175 |

100 |

250 |

175 |

150 |

200 |

You can also check out service: Dissertation help london

M2 Applying management accounting techniques

Problem 2:

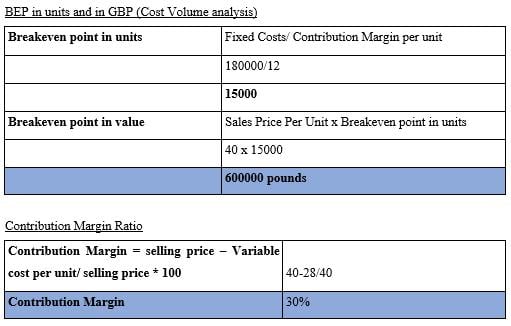

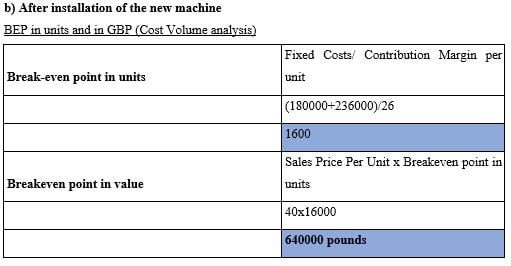

a) Before installation of the new machine

d. Recommendations

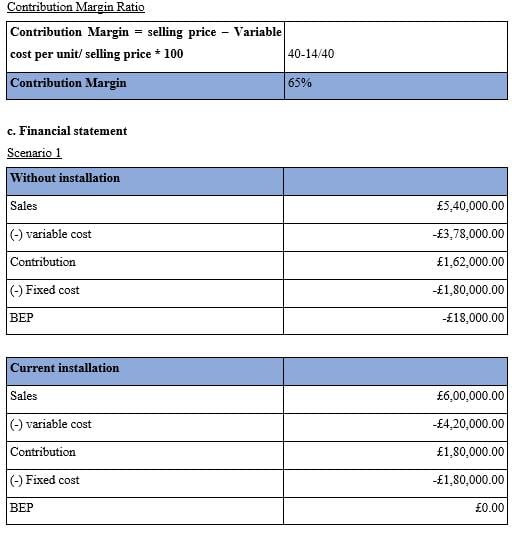

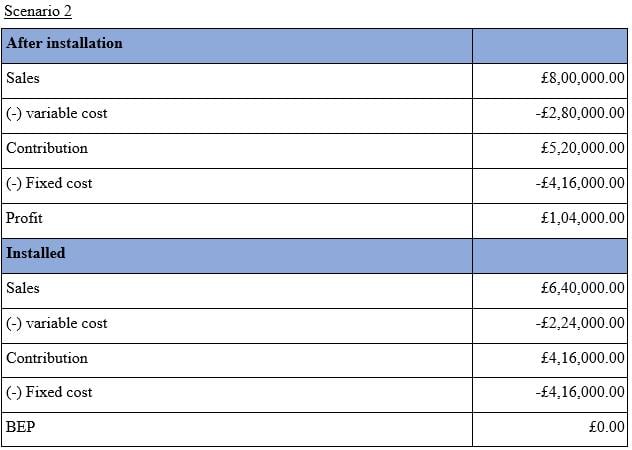

By considering above cost volume analysis, it is recommended to the organisation that they must install the new machinery as the company will earn high sales revenue. From the above analysis, it can be seen that after installation of machinery, this company is receiving high benefit with same cost and volume.

D2 Interpretations

Income statements for Alpha Ltd. is prepared using management accounting techniques of marginal costing and absorption costing. With marginal costing, it has been analysed that Alpha Ltd. is capable of introducing new pizza formula as they will earn 200000 pounds at the end of the period. On the contrary, this organisation will earn 180000 pounds at the end of the period. The difference between the profit of marginal and absorption technique is due to non absorption of fixed expenses in the vase of marginal costing due to which net profit in this case is higher.

You can also read: Concept of Financial Accounting

TASK 3

P4 Explaining advantages and disadvantages of different types of planning tools along with their use in an organisation

Planning tools are the methods which helps an organisation to predict their future in such a way that it can facilitate to forecast future contingency so that relevant provisions for them can be prepared (Mishan, 2015). These planning tools are used by an organisation in order to forecast future issues, so that management accounting systems can be prepared so that those financial issues can be well controlled. Few planning tools along with their advantages and disadvantages in context of Alpha Ltd. are analysed below:

Zero based budgeting

This planning tool is a budget which prepared every year from the zero base. This budget is developed with a zero base regardless with the amount which last period’s budget. Alpha Ltd. can use this budget which can help the managers of this organisation to look over every single penny which they have spent in the current year so that they can justify all the operating expenses. This planning tool also helps in considering the future economic shocks like recession (benefit).

This budget also has few disadvantages which can restrict Alpha Ltd. to use this planning tool. Zero base budget requires high skilled for which; this company has to hire new management accountant which will ultimately result in cost increment. Also, zero base budget can easily be manipulated by the managers (Tamandeh, 2016).

Production budget

This budget is a financial planning tool which helps in predicting future production units and costs which will be incurred producing those products (Mohamed, Kerosi and Tirimba, 2016). This tool includes estimated production capacity and demand for those products. Alpha Ltd. can use this budget to first analyse the demand for their products in market and then develop a production budget which they can include their estimate number of products which are can be produced by them and the cost will be incurred in this course. Benefit of this planning tool is that it can help organisations like Alpha Ltd. to ensure maximum utilisation of their inventories and material, labour, overhead can be monitored at once. This tool also has few disadvantages which includes usage of plenty time and money.

Cash flow budget

Cash flow budget is a planning tool which helps in forecasting the future cash inflows and outflows. The aim behind developing this type of budget is to ensure whether or not organisation will have enough liquid funds to pay off their future debts. This budget can facilitate Alpha Ltd. by its benefits which are identification of potential deficits and ensuring liquidity.

This planning tool also has few disadvantages which restricts Alpha Ltd. to use this planning tool. An organisation can face issue of restrictive spending limit and ability to build a credit profile due to developing cash flow budget.

The above mentioned planning tools can help an organisation such as Alpha Ltd. to plan for their future and predict issues which can be faced by them in future. All these planning tools can even result in resolving the financial issues by developing contingency plans.

M3 Analysing the use of different planning tools and their application for preparing and forecasting budgets

Planning tools such as operational budget, cash flow budget and zero based budget can be used by an organisation such as Alpha Ltd. to forecast their future revenues and expenses and then record them in a forecasting budget by which they can predict contingencies and develop preventive measures so that they can lead growth and development. For instance, Alpha Ltd. can use cash flow budget to determine their future cash availability and then record them in a forecasting budget so that relevant cash can be ensured in the company.

P5 Comparative analysis

In order to execute organisational functioning in well defined manner entities are required to have sufficient amount of funds. As if company cannot able to allocate proper funds for their operational activities then they may find themselves into financial issues and problems. It has been ascertained that Alpha Ltd is facing issues related to finance which is being further discussed below:

Errors in accounting records: It has been identified that if accounting reports that are duly get generated on yearly basis have issues and errors then it will lead towards improper information related to funding (Otley, 2016). In context with Alpha Ltd, it has been ascertained that company is also going through this issue as accountants of organisation are not able to develop accounting records accordingly.

Inadequate protection of assets: If assets that has been acquired by organisation as to execute functioning are not properly protected in an appropriate manner then this may further lead towards lack of funds for organisation. Alfa Ltd, currently deals with the issue of inadequate protection of assets and it further affect their operations.

As to effectively execute organisation functions in well defined manner manager of entity are required to ascertain and overcome financial issues. In order to undertake process of identification entity take advantage of techniques that are being defined below:

- KPI (Key performance Indicators):

With the help of this performance management tool organisation can effectively able to determine the steps that are being undertaken by entity as to conduct operations in order to fulfil predetermined standards. This tool aid Alpha Ltd to make effective identification of issues related to inadequate protection of assets. Thus, KPI allows manager to have effectively evaluation of problems and formulate well defined solutions accordingly (Tschopp and Huefner, 2015).

- Benchmarking:

In this policies of organisation get compared with other entities in order to identify errors within management system. This technique will aid organisation accounting professionals as to determine mistakes that has been made by them during the time of recording information related to finance. With the help of this managers of Alpha Ltd can identify errors in their accounting system as further undertake comparison with other entities in same sector.

As to effectively deal with all issues Alpha Ltd managers undertake use of financial governance:

Financial governance:

This process involve recording, monitoring and collection of financial information as per according to accounting principles (Williams and Dobelman, 2018). This will allow organisation to effectively track down all financial transactions in order to manage and control resources exploitation. In Alpha. Ltd. Managers undertake use of this as to challenge financial issue related to non protected assets and accounting records.

You can also check out services: Teaching assistant level 2 assignments

- Comparison of companies:

|

Basis |

Alpha Ltd |

Chicago Town |

|

Cost accounting system |

Organisation manager undertake use of this system as to effectively identify problems and deal with errors that pertains in accounting records by considering cost that include different transactions that are being made by entity. |

Management is taking use of cost accounting system as to effectively deal with financial issues related to unforeseen expenses as it allows them to ascertain fund that are required by them in future and further allocate the sources to collect adequate funds. |

|

Inventory management system |

Inventory management system has been undertaken by organisation as to effectively manage inventory as if entity manage stock in well defined manner them assets can be duly protected for any kind of exploitation. |

Organisation management use this system as to challenge the problem related to lack of inventory for future operations. It will allow them to have minimum level of stock within their warehouse as to further conduct operations smoothly. |

M4 Critically analyzing how the organisations use management accounting systems to lead to sustainable success

Management accounting systems such as cash accounting system and inventory management system along with management accounting technique of KPI and benchmarking benefits an organisation to predict future financial issues and then rectify then using provisions will lead them towards sustainable success (Ye, Yang and Tan, 2015). These systems and techniques require high skills to be executed, organisations which does not have enough financial resources to hire skilled personnel has to negatively impacted by this procedure.

D3 Critically evaluating how planning tools for accounting respond appropriately to solving financial problems to lead organisations to sustainable success.

Budgetary planning tools such as operational budget, cash flow budget and zero based budgeting helps organisation to forecast issues which can be faced by the management of the organisation in future. These predicted issues are then resolved by the organisation using techniques of financial governance and KPI. This way planning tools indirectly helps in solving financial issues which leads company towards sustainable success.

CONCLUSION

At the end, it can be concluded that there are various types of management accounting system and companies use them for increasing their overall efficiency. It allows them to reduce confusions and synchronize different tasks of the organization. reporting methods are used for checking the work done by teams, variety of reports help firm in making future plans by depicting positives and negatives. Marginal costing always shows higher profit compared to absorption as it does not absorb fixed cost. Zero based budgeting, cash flowing budgeting operational budgeting are effective planning tools, they play crucial role in construction of medium and short term plan. Every organization face many problems but accounting systems support them in resolving financial problems. Company can respond to a problem by adopting suitable accounting system.

REFERENCES

- Almaktoom, A. T., 2017. Stochastic reliability measurement and design optimization of an inventory management system. Complexity. 2017.

- Carlsson-Wall, M., Kraus, K. and Messner, M., 2016. Performance measurement systems and the enactment of different institutional logics: insights from a football organization. Management Accounting Research. 32. pp.45-61.

- Chenhall, R. H. and Moers, F., 2015. The role of innovation in the evolution of management accounting and its integration into management control. Accounting, organizations and society. 47. pp.1-13.

- Jamil, C. Z. M. and et.al., 2015. Environmental management accounting practices in small medium manufacturing firms. Procedia-Social and Behavioral Sciences. 172. pp.619-626.

- Jukic, O. and Hedi, I., 2014. May. Inventory management system for water supply network. In 2014 37th International Convention on Information and Communication Technology, Electronics and Microelectronics (MIPRO) (pp. 567-570). IEEE.