Question :

LO1.Discuss an understanding of management accounting systems.

Briefs and Guidance

Write a report on the role and function of the management accounts department, covering the management accounting systems operating in the organization as well as the range of techniques used. The report should cover three key elements:

- Examine the management accounting and the essential requirements of different types of management accounting systems. Also, evaluate the benefits of management accounting systems and their application within an organizational context (such as GSQ Limited) in order to strengthen your report.

- explanation of different methods used for management accounting reporting.

LO2. Provide a range of management accounting techniques.

GSQ ltd has approached your company for an advice regarding the use of a suitable management accounting tool which it can use its processes. Your line manager has handed the task over to you, and you are required to prepare a report as well as (PowerPoint) presentation slides using the information from GSQ ltd.

Calculate costs (cost per unit and total cost and produce financial reports (such as income statements) in order to interpret data for a range of GSQ activities.

GSQ Ltd makes and sells a single product. In October 2018:

Output and sales 50,000units.

Selling price per unit £30.00

Direct materials cost per unit £8.00

Direct wages per hour £9.00

Variable manufacturing overhead per unit £2.00

Variable selling expenses per unit £4.00

Fixed manufacturing Overheads £160,000

Fixed admin and distribution costs £60,000

Direct manufacturing labor per unit 20 minutes.

LO3 Examine the use of planning tools used in management accounting.

LO4 Explain ways in which organizations could use management accounting to respond to financial problems.

As a role of assistant accountant, you have been asked by your line manager to provide another report which examine the organization’s use of planning tools to ensure financial stability and performance as well as ways in which management accounting has played a key role in preventing and solving financial problems. Also, cover the following in the report:

- Explanation of the advantages and disadvantages of different types of planning tools used for budgetary control.

- Compare how organizations are adapting management accounting systems to respond to financial problems. In addition, you may also analyses how, in responding to financial problems, management accounting tools can lead organizations to sustainable success. Also, provide the appropriate example of it.

|

Learning Outcomes and Assessment Criteria |

||

|

Pass |

Merit |

Distinction |

|

LO1.Discuss an understanding of management accounting systems. |

D1 Critically analyse how management accounting systems and management accounting reporting is integrated within organisational processes. |

|

|

P1 Examine management accounting and give the essential requirements of different types of management accounting systems. P2 Identify different methods used for management accounting reporting. |

M1Analyse the benefits of management accounting systems and their application within an organisational context. |

|

|

LO2. Provide a range of management accounting techniques. |

D2 Provide financial reports that accurately apply and interpret data for a range of business activities. |

|

|

P3 Calculate costs using suitable methods of cost analysis to produce an income statements using marginal and absorption costs. |

M2 Use a range of management accounting techniques and produce appropriate financial reporting documents. |

|

|

LO3 Examine the use of planning tools used in management accounting. |

LO3 & 4 D3 Assess how planning tools for accounting respond appropriately to solving financial problems to lead organisations to sustainable success. |

|

|

P4 Identify the advantages and disadvantages of different types of planning tools used for budgetary control. |

M3 Evaluate the use of different planning tools and their application for preparing and forecasting budgets. |

|

|

LO4 Explain ways in which organizations could use management accounting to respond to financial problems. |

||

|

P5 Analyse how organisations are adapting management accounting systems to respond to financial problems. |

M4 Assess how, in responding to financial problems, management accounting can lead organisations to sustainable success. |

|

Answer :

INTRODUCTION

Management accounting can be defined as the process in which the reports of business operations are prepared, these reports helps the business manager in making the short term or long term decisions of company. It have the task of identifying, analysing, measuring, communicating and interpreting the financial information to the users. Report is about GSQ and it will be revealing the importance of management accounting systems, management accounting reports, the different types of management accounting techniques. It will also be providing about the planning tools in budgetary control. The study will also be revealing about the different management accounting methods for responding to financial issues.

LO1

Management accounting

This is also known as cost accounting or managerial accounting. This is also defined as the process used for analysing cost and operations for preparation of financial reports and records. Management accounting is used by managers for translating the financial and costing information into useful information for the effective decision making in the organisation. Management accounting is for internal use by the managers and executives for achieving higher efficiency and productivity at minimal costs (Maas, Schaltegger and Crutzen, 2016).

Management accounting systems

Management accounting systems are used by the organisation for keeping the business over a defined structural path. This refers to the management techniques used in management accounting for having proper record of all the financial data and information.

Cost Accounting

Cost accounting systems refers to the accounting system used for having proper record of all the cost of company. This helps the business in analysing the incomes and expenditures of the company that it will be earning in the given year. It involves applying range of costing concepts and techniques over the business operation with the motive of keeping the costs under control and achieving maximum productivity. It is used by GSQ in the production process for calculating the costs of manufacturing a product.

Benefits

- Cost accounting helps in keeping record of all the costs incurred by business.

- This involves various tools and techniques for keeping the costs under control.

- This helps business in assessing the variations between actual and budgeted outputs.

Inventory Management

Inventory management can be defined as combination of technology and software that is helping organisations in keeping track of all the movements of inventory. Inventory management is used for having record of company assets, raw materials and finished goods. Using this management is able to analyse the consumption of raw materials frequency of movement in finished goods. It provides important information for decision-making to management(Ameen, Ahmed and Abd Hafez, 2018). Inventory management system is applied in warehouse and production house of company for having a proper record over the inflow and outflow of inventory.

Benefits

- Inventory management is a useful that enable GSQ in having proper record of all the movements of stocks.

- This used by management in decision making and forecasting.

- It also helps in placing purchase order on time so that the production process is not interrupted.

Price Optimisation System

The management accounting system involves measuring the fluctuations in demand at different price levels. This method is used by organisations for defining optimum prices for its product that will be most favourable for it. Businesses uses this model as powerful lever for earning profits by pricing its products. Companies decide prices depending how customers will be responding to them at different prices. It also takes into considerations other factors influencing the pricing models. GSQ applies this model for forecasting the demand of its products at different price levels including the inflation factors.

Benefits

- This is an efficient method involving mathematical programs that helps in accurate forecasting.

- Prices that will be most beneficial and acceptable are decided using the optimisation model.

- This is an effective tool used in decision-making by management.

Job Costing System

It is a accounting concept used for tracking the expenditures and revenues from a particular job. This involves complete detail of all the costs incurred by organisation over a job like raw materials, labour and overhead. Job could also be defined as specific job done for single customer or related to single product line or batch of units with all the same products (Nitzl, 2016). The profitability of job is decided after properlyh assessing the costs of each operation. This is applied by GSQ for assessing the costs on a particular order by customers.

Benefits

- This is used by organisations for the business enterprise for assessing cost of each job separately.

- It enables company in deciding the profit margins for each job done by company.

You may also visit at - Corporate Accounting System by Australian Accounting Board

Management accounting reporting methods

Management accounting reports provide important information to the users of financial information in decision making processes. There are various accounting reports used by GSQ in effective decisions

Performance Report

This report contains information related to the performance of activities and operations of business. This provides management with analysis about the level of targets achieved by the organisation in given time period. This contains details about the targets and the achievements. This is essential for assessing the efficiency of its management in achieving the targets. Performance report not only includes the operational performance but all also the performance of individuals and employees of company. This helps the managers in identifying the employees who are performing well so that they can be motivated with rewards and incentives for maintaining their efforts.

Budget reports

These reports can be termed as the spending plan of the business. Budgets are prepared by making forecasts about the future income and revenues. These forecasts are made by companies after analysing both internal and external forces affecting the budgets. These are prepared analysing the budgets of previous year and making adjustment according to the current scenarios like demand and inflations. Budgets are very useful for organisations for having a proper structure for its expenses. This helps GSQ in allocating its resources most appropriately so that the costs decided do not go out of the budgeted levels (Averinа, Kolesnik and Makarova, 2016). Budgets are used by organisations for keeping the costs under control and taking corrective measures for achieving the desired level of outputs.

Cost Accounting Report

Cost accounting reports contain the detailed analysis about the costs occurred for manufacturing a product. It present all the variable and fixed cost separately that helps the business in deciding the cost of product. Costing technique also involves making forecasts using the information available with the business. Costing involves making comparisons about the budgeted and actual level of outputs. This helps business in assessing the variances for which company takes effective policies and procedures for reducing the variances and achieving the required targeted objectives. Cost reports helps company in deciding the adequate profits margins for the product so that it may attain the profitability and desired business objectives.

LO2

Management accounting costing techniques.

GSQ is a manufacturing concern that will be using different management accounting techniques for reporting the business transactions. The different management accounting techniques that will be used by the management accountants are marginal costing and absorption costing. These are used for carrying out the profits from business operations.

Absorption Costing

Absorption costing is also known as full costing method that are acceptable under the accounting standards. The costing method is used for calculating the net income and for valuing inventory. It is used by organisations for absorbing the manufacturing costs including both the variable and fixed costs. The costing method includes both variable and fixed costs for calculating the cost of product. Absorption costing is considered for analysing the accurate and more comprehensive view for the business. As compared with the marginal costing method it includes the fixed costs and variable costs in pricing the product.

Advantages

- The methods is acceptable as per accounting standards for valuing the inventory.

- It takes into account fixed costs incurred for manufacturing the product.

- The disclosure of under and over absorption helps in analysing the inefficiency in production methods.

Disadvantages

- The method is not useful in making comparisons of two products.

- The costing method is not used in decision-making.

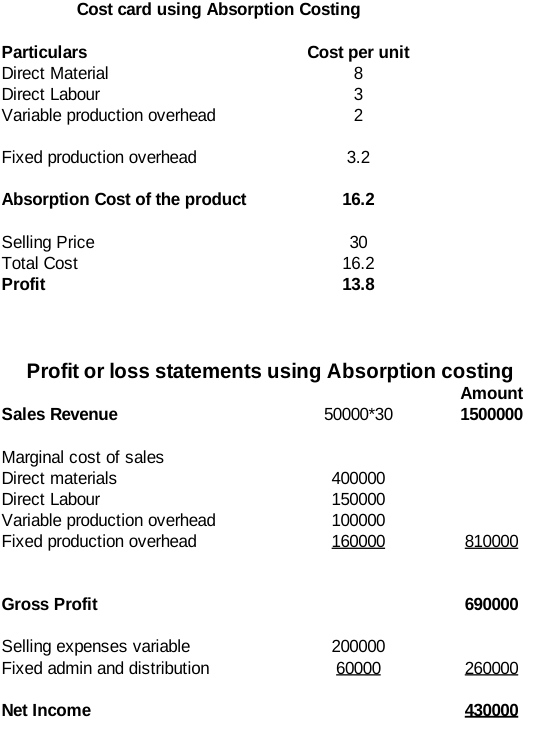

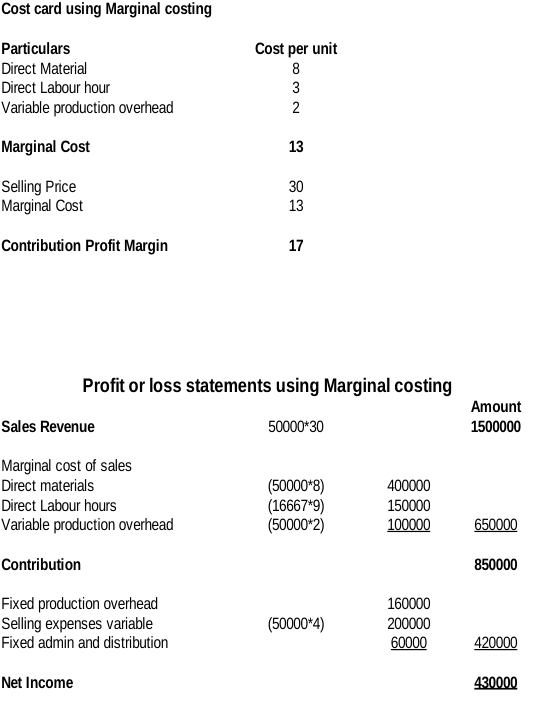

Reports under Marginal and Absorption Costing

Absorption Costing

Marginal Costing

The marginal costing method is used by company to measure the products cost. It is used in calculating the costs of products incurred in manufacturing them. In this costing method variable costs are charged on per unit basis. The concept is based on behaviours of costs with change in volume of output. This is also known as variable costing method as it only considers variable costs for pricing the product and fixed costs are considered as period costs in marginal costing technique. The marginal costing is different from absorption costing that covers the variable as well as fixed cost for pricing the product.

Advantages

- Marginal costing method is easy to understand and interpret the results.

- The fixed costs are eliminated which makes the comparison of products easier.

- The system helps in assessing the break even points for forecasting the sales level.

Disadvantages

- The segregation of cost between the variable and fixed costs is difficult.

- The method is not accepted by accounting standards as inventory is undervalued

Reports under Marginal and Absorption Costing

Absorption Costing

Marginal Costing

LO3

Different types of planning tools

There are different types of planning tools available for budgetary control. A detailed description is given below.

Zero based budgeting: It is a method of budgeting in which budget is prepared from the zero. Every function or department within an organization is analysed based on its needs and cost. All expenses are justified for each new period (Miller, 2018). It involves re-evaluating each item of cash flow and justifying the expenditure that are required to be incurred by the department.

Advantages:

- It justifies all operating expenses.

- It scraps the obsolete processes which helps in better costing and better profitability.

Disadvantages:

- Process can be manipulated by managers to get more resources to their department.

- It requires lot of time and efforts.

Capital budgeting: It is the formal business process for evaluating whether to invest in a particular project and asset or not (Abor, 2017). It refers to the decision in relation to the investment of the funds in addition, modification or replacement of fixed asset.

Advantages:

- It helps in identifying the risk.

- It provides complete report with respect to different projects.

- Helps in placing adequate control over expenditure.

Disadvantages:

- Mostly decisions are taken for long term.

- It requires professionals with high skills.

- Introspective in nature due risk and discounting factor.

Cash budgeting: It is an estimation of cash flow for a specific period which includes expected cash receipts and disbursements (DeFranco and Schmidgall, 2017). These cash inflows and outflows include revenue collected, expenses paid, repayment of loan etc. This budget is usually made after preparing sales, purchase and capital expenditure budget. It is prepared to assess whether company is having sufficient cash to operate its business or not.

Advantages:

- It prevents over spending by the organization.

- It helps in analysing the resources available to meet the operational needs.

- It also helps in analysing minimum liquidity and cash balance requirement.

Disadvantages:

- It limits the spending power.

- It does not reflect correct profit as it is based on assumptions and also it considers cash flows from security deposits etc.

- It is prepared based on the previous year cash allocation so there is no guarantee cash flow will be similar in the future.

So, it can be said that planning tools are very essential for the GSQ Ltd. All these tools have its own advantages and disadvantages. The application of these methods in an organization will lead to increase its profitability and reduce risk and efficient management of the business.

LO4

Comparing ways organization can use management accounting system

Benchmarking: It is the process which helps in measuring the performance of the organization, its products and processes. It is measured by comparing the company's performance to its competitors. It helps in identifying the internal opportunities available to the organization for further improvement (John and Eeckhout, 2018). For example by comparing the superior performance and breaking down it to analyse what makes it superior and then comparing those processes with the organization and then implement the changes as per the requirement. It helps in improving the performance, productivity and profitability of the organization.

Key performance indicators: It is a performance measurement indicator which evaluates the success of the organization based on certain indicators. It demonstrates how effectively organization is achieving its objectives and goals. KPIs differ from organization to organization and it is implemented at different levels to evaluate the success. Mostly, low KPIs are set for processes in departments such as sales, marketing, HR etc. The high KPIs are focussed on the overall performance of the organization. KPIs can be of different types such increase in sales level, achieving the targeted outcome etc.

Balanced scorecard: It is a performance management metrics used by the organization to identify and improve the business functions and their performance based on outcome. It allows businesses to look at its business from different perspectives which includes financial and customer perspective, internal business perspective and innovation and learning perspective. It is used to measure and provide feedback to the organization. It links vision to strategic objectives, targets and initiatives. It is a business performance measurement tool.

Variance analysis: It is analytical tool which is used for the analysis of difference between actual performance and the standard performance. This analysis is used for exercising control over the business. For example, budgeted sales is £10000 and the actual sales is £8000, in this situation variance analysis will give a difference of £2000. It also helps in analysing the reason for such difference and corrective actions are taken (Marzlin Marzuki and Ismail, 2019). The detailed analysis of this allows management to identify the reason of fluctuation in its business and the steps that can be taken. The variance analysis is of different types which includes purchase price variance, selling price variance, labour efficiency variance, fixed and variable overhead spending variance etc.

|

GSQ limited |

Sun Mark Limited |

|

The GSQ limited uses variance analysis and balanced scorecard system for measuring its performance. The balanced score card help GSQ Ltd in strategic planning, better analysing management information accompanied with improved and relevant performance reports. Variance analysis helps the organization in efficient and forward looking budgetary decisions. It also acts as a control mechanism in respect to cost. |

Sun Mark Limited uses benchmarking and key performance indicators. Benchmarking helps in gaining perspective about the performance in comparison to its competitors. It also helps in setting performance expectations, monitor the performance of the company and implement changes. The key performance indicators provides right information which helps in informed decision making, allows users and managers to measure target, establishes transparency in the organization. |

Get the best Help with Dissertation for your dissertation writing work.

CONCLUSION

It can be concluded from the above that management accounting is very beneficial to business organization. It helps in proper and complete analysis of the financial and non-financial aspects of the organization and helps in taking better decisions. The benefits and techniques of management accounting that is very useful for the business if implemented properly. It also included advantages of different planning tools for budgetary control and also a comparison has been drawn with another company with respect to the management accounting technique used. Thus, management accounting is important for every organization.

REFERENCES

Books and Journals

- Abor, J. Y., 2017. Evaluating Capital Investment Decisions: Capital Budgeting. In Entrepreneurial Finance for MSMEs (pp. 293-320). Palgrave Macmillan, Cham.

- Ameen, A.M., Ahmed, M.F. and Abd Hafez, M.A., 2018. The Impact of Management Accounting and How It Can Be Implemented into the Organizational Culture. Dutch Journal of Finance and Management, 2(1), p.02.