Question :

Learning Outcomes

a) Discuss an understanding of the concepts and theoretical approach of Company Accounting with Accounting standards.

b) Examine the purpose and practical applications of the requirements pertaining to a range of key areas of corporate accounting practices.

c)Evaluate and interpret issues relating to accounting for companies.

d)Devise and critically evaluate the contextual and theoretical aspects of accounting for groups

e) Implement the accounting standards of Corporate accounting for share capital, Leases and company tax.

f) Highlight accounting standards for group of entities, Business combination and consolidation g) Use the Principle of Fair value cash flow statement and Impairment Loss.

Assessment Descriptions

This assessment is developed to analyse the students’ ability to research and implement accounting standards and interpret how to apply relate corporate accounting concepts to various scenarios. It examines students’ problem solving and researching skills and enables them to deal with the financial affairs of a company. It consists of 2 sections; the first section covers the researching skills and section 2 cover case studies with complex calculations which allows the students to use relevant accounting standards to the real-life case.

Answer :

INTRODUCTION

Corporate accounting relates to the analysis and reporting of fiscal statements and records. This typically points to accounting concerning larger organizations instead of narrower-scale small businesses or partnerships in which the reporting account specifications and requirements appear to be less strict. That's because companies have a responsibility to serve the general public and legislative authorities with financial information, while smaller firms don't have that obligation (Parker, 2013).

The study evaluates the method of acquisition as prescribed in AASB 3 / IFRS 3 issues by the Australian Accounting Standards Board. Further, this study contains a practical sum of the acquisition of Davis Ltd by Alma Limited.

TASK

PART A

Acquisition method in AASB-3 / IFRS-3:

The accounting standard applicable concerning accounting related to the event of business combinations is AASB-3 “Business Combinations” which was primarily issued by the Australian-Accounting Standards Board in 2008, March that is the similar Australian equivalent of IFRS-3 “Business Combinations” which is issued by International-Accounting Standards-Board (IASB) in 2008, January. In the AASB-3, Appendix-A incorporates defined-outlined terms, whereas Appendix-B incorporates practical application guidelines: both the Appendixes are a significant integral portion of AASB-3. Regulatory body IASB also has drawn basic guidance for conclusions on IFRS-3, although it's not an inherent portion of the standard (Johansson, Hjelström, and Hellman., 2016).

According to AASB-3, business acquisition is a contract or other circumstance whereby an acquirer gets ownership of any other business. There must be an economic agreement/event between two organizations in which ownership of a firm is passed from one entity to another. This standard also provides specific guidelines on the method of acquisition and other relevant information. According to it, when a business is acquired, all the assets are valued at their fair value. Here as per this standard assets are those items that are capable of providing a return (Guthrie and Pang, 2013).

The acquisition method is the required approach/method for accounting for any business combination as prescribed in AASB-3, para 4. This involves four major steps as stated in standard para 5. The first one is the identification of the acquirer, then the determination of the acquisition date/period. Thereafter recognition and assessment of overall identifiable acquired assets and liabilities as well as any other non-controlling interest related to the acquisition process. Lastly, assessment of goodwill or any gain generated through purchase considerations. The process of purchase is enforced on the day of purchase, which is the day the acquirer acquires control over the acquiree. The business combination usually occurs on such a specific date. AASB 3 also lays out criteria for the corresponding assessment and accounting of assets and liabilities originally recognized at the date of purchase (Glaum, Schmidt, Street, and Vogel, 2013).

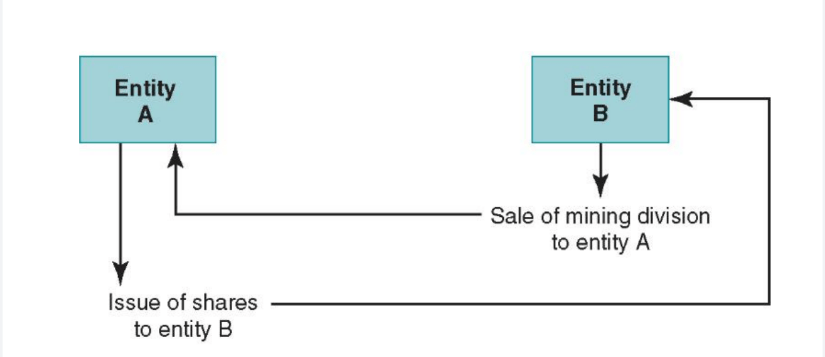

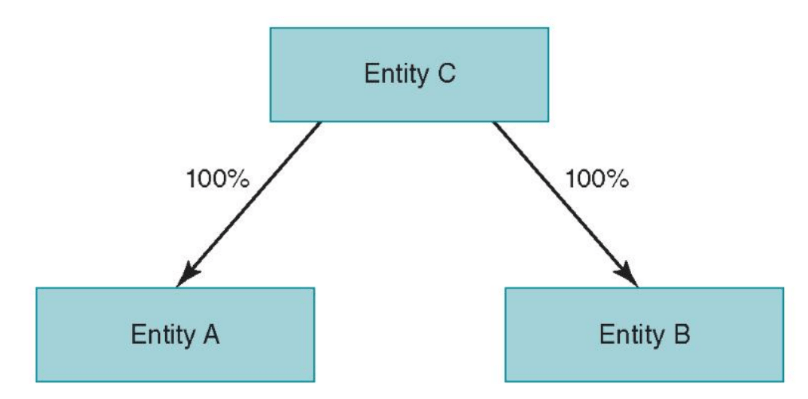

Para seven of AASB 3 notes that the purchaser/acquirer is the entity/firm that takes ownership of another firm/entity. Here appendix A of this standard defines acquiree and acquirer. Businesses/businesses over which the acquirer gains control under the business acquisition process are called acquirees while a business entity that gains control (ownership) is called an acquirer. The primary factor, then, is control in determining an acquirer/buyer. This concept is the same as specified in AASB-10 Consolidated Financial Statements employed to describe the apparent-subsidiary relationship. According to it control of the investee exists in case the investor is being entitled/exposed, or holds rights, to uncertain returns via its involvement as an investee as well as the ability to impact such returns by his power over the investee. In certain cases, it is quite straightforward to recognize an acquirer/buyer. For instance, in case Enterprise A gains more than half of Enterprise B's assets, Enterprise ' A ' can have influential control over Enterprise' B ' as Enterprise A has more than half of enter B's voting rights and influence over Enterprise B's management. In other cases, judgment-formation is needed when defining an acquirer. Consider the context in which entity A merges with entity B. A new corporation (entity C) is created to impact the merger, which offers securities for the purchase of all shares of both corporations A and B. Eventually, the subsequent organizational structure would be as follows:

As C is formed alone to formalize the entire organizational structure, this is not an acquirer, however, this can be regarded as the legal parent/owner of both respective entities. As stated in Annex B to AASB 3, para B18, one of the organizations that prevailed before the mixture should be defined as an acquirer because Entity C is not a significant party to decisions related to a business combination, only part of the organizational structure that was formed to enforce entire combination. As previously noted, when Entity A is known as the acquirer, then B (acquiree)'s assets and liabilities are assessed at fair value at the acquisition date (Hamberg and Beisland, 2014).

The second step is recognizing the effective acquisition date, thus is regarded as a particular date at which the buyer/acquirer gains control over the targeted business entity. This date in a business context is quite crucial since the value of aggregate amounts involved in processes of business combination is generally assessed at such date as well and the buyer initiates the consolidation process of target-entity for accounting-purpose. Here another considerable criterion to define acquisition date is the use of control which ensures that the actual substance behind the transaction/event determines the accounting aspect instead of a form of event/transaction. For instance, assets acquired under business combination may be acquired in different stages/payments so in the case of these assets, acquisition is made over a different point of time with no. of payments. As specified in para-nine of AASB-3, on the closing date of combination-process, the acquirer/purchaser lawfully transfers purchase consideration in cash or shares as well as acquires assets/liabilities of the acquiree-entity, although in several cases this can not be considered as acquisition date. The meaning of acquisition date then refers to a point in time whenever the acquirer's net assets became the acquirer's net assets— the date on which the acquirer will recognize net assets obtained in his accounts. This method is compatible with the Framework that an asset is described in para 49(a) about future economic benefits that an agency manages (Tsalavoutas, André, and Dionysiou, 2014).

Recognizing and assessing non-controlling interests and assets & liabilities is a major step in a business combination. The cumulative assets as well as assumed liabilities required to be listed/recognised individually as per the relevant guidelines of IFRS3. Here assets are likely future economic benefits achieved, and obligations/liabilities are regarded as likely future expenditures. Identified or recognized intangible assets must fulfill several conditions such assets should originate through contractual or any legally enforceable rights and must be capable of separate from enterprise. Here notable thing is that Intangible assets that have finite lives should be amortised over their entire useful life. This standard prescribes that identified assets/liabilities should be valued at fair value on the acquisition date. Even though the acquirer/purchaser doesn't acquire 100 percent of the targeted enterprise, all the acquired assets/assumed liabilities are reported at their respective 100 percent of fair value. Once all the assets/liabilities are being reported, related accounts for such generally consider aspected accounting principles that are otherwise mandated to them (Eloff and de Villiers, 2015).

In the situation of partial acquisition, fair value on the acquisition date of non-controlling interest should be recognized first. In this context, a non-controlling interest refers to equity-holding of a business that is owned by minority holders i.e. less than 50 percent interest. In case the acquirer holds a current interest in the target company, then its fair value is required to be assessed as of the acquisition date. This can be assessed in 2 specific manners; the first one is proportionate sharing of fair value in the entity's net assets whereas the second is fair value depending upon shares' market value.

Goodwill resulting from the corporate combination on the date of acquisition is regarded as intangible assets in the acquirer's balance sheet. The asset is determined as an excessive amount of entire acquisition costs over the buyer’s interest in terms of the fair value of aggregate assets/liabilities acquired. After the business combination process, in the books of the acquiring enterprise goodwill is recognized and shown as an intangible asset under the head of the non-current asset in the balance sheet. This amount of goodwill is not to be amortized but it should be impaired periodically. In case acquisition costs are lower than the net value of assets and liabilities acquired there would be a negative amount of goodwill. When initial computations of the value of goodwill are considered appropriate, then the amount of negative goodwill should be written off and the entire gain should be recognized in the income statement. Thus, Negative excessive amounts should be recognized instantly in P&L. Here fair values of assumed liabilities are typically measured against present values of projected future cash outflows. Any losses or any other expenses that are expected to occur from the merger aren't the acquirer's liabilities and therefore are not reflected in the estimation of the fair value of the entire consideration received (Baboukardos and Rimmel, 2014).

Read Also:- Corporate Finance Assignment Help

PART B

Given Information:

Alma Ltd - - - - - - - - - (acquired all issued shares (ex-dividend.)- - - - - - - - - - - - > Davis Ltd

Acquisition date: 1st July 2018

Purchase consideration: $1239870

In books of Davis Ltd:

|

Reported dividend payable : |

$ 25000 |

|

Share capital : |

$ 434000 |

|

Asset revaluation surplus : |

$ 186000 |

|

Retained earnings : |

$ 149000 |

|

Account |

Cost |

Carrying Amount |

Fair value |

Further life- in Year |

|

Inventories (90% was sold by 30 June 2019 and 10 % sold by 30 June 2020) |

$1,86,000 |

$3,35,000 |

||

|

Land |

$3,72,000 |

$6,70,000 |

||

|

Vehicle |

$5,21,000 |

$4,34,000 |

$7,81,000 |

4 |

Tax Rate: 30 percent.

Acquisition analysis on 1 July 2018:

|

The Net fair value of identifiable assets and liabilities of Davis Ltd |

= |

($ 434000 + $ 186000 + $ 149000) (Equity) |

|

149000 |

= |

+ ($ 335000 - 186000) (1 – 30%) (Inventory) |

|

298000 |

= |

+ ($ 670000 -372000) (1 – 30%) (land) |

|

347000 |

= |

+ ($ 781000 - $ 434000) (1 – 30%) (Vehicle ) |

|

= |

$ 1324800 |

|

|

Net consideration transferred |

= |

$ 1239870 - $ 25000 |

|

= |

$ 1214870 |

|

|

Gain |

= |

$ 1324800 - $ 1214870 |

|

= |

$ 109930 |

Consolidation worksheet entries for Alma Ltd’s group on 30 June 2019:

Business combination valuation entries:

Inventories A/c Dr. $ 149000

Deferred Tax Liability $ 44700

Business combination valuation reserve $ 104300

land Dr. $ 298000

Deferred Tax Liability $ 89400

Business combination valuation reserve $ 208600

Vehicle A/c Dr. $ 347000

Deferred Tax Liability $ 104100

Business combination valuation reserve $ 242900

Share Capital Dr. $ 434000

Retained Earning [186000 -109930 (gain)] Dr. $ 76070

Asset revaluation surplus Dr. $ 149000

Dividend Payable Dr. $ 25000

Business combination valuation reserve Dr. $ 555800

Shares in Davis Ltd $ 1239870

Get the best Accounting Assignment Help online from the experts.

CONCLUSION

From the above report, it has been articulated that corporate accounting is a crucial aspect of the current corporate world. It is a wider aspect that involves different aspects of accounting related to large corporations. This also involves IFRS and AASB which guides the entire accounting practices used in companies. These standards also include the acquisition method which is generally applied in accounting for business combinations.

REFERENCES

Books and Journals:

- Parker, R.H. ed., 2013. Accounting in Australia (RLE Accounting): Historical Essays. Routledge.

- Guthrie, J. and Pang, T.T., 2013. Disclosure of Goodwill Impairment under AASB 136 from 2005–2010. Australian Accounting Review. 23(3). pp. 216-231.