Introduction

Business decision making is highly concerned with the selection of best option out of several alternative available. In the business unit, manager of the firm can take suitable decision by undertaking several statistical and non-statistical tools. Moreover, statistical techniques and project management software helps in making suitable decision that aid in the growth and success of firm. Growth and success of the firm is highly affected from the extent to which effectual and profitable decisions are undertaken by the manager. The present report is based on the case situation which presents that retail business unit is offering two kind of products such as economics and luxury. In this regard, the present report will shed light on the inventory management tools and correlation measure. Besides this, report will provide deeper insight about the manner in which investment appraisal techniques aid in decision making aspect.

Task 1

Assessment of selling price and profit level

To assess the number of units sold selling price level is assumed by the retailer by taking into account the market trend as well as conditions.

|

Particulars |

Economy (in $) |

Luxury (in $) |

|

|

Assume selling price |

80 |

150 |

|

|

Holding cost |

0.8 |

7.5 |

|

|

Selling price total |

8.3 |

|

|

|

|

|||

|

Month |

Number of units sold in economy range |

Number of units sold in luxury range |

|

|

Jan |

91.13 |

23.32 |

|

|

Feb |

121.5 |

34.43 |

|

|

March |

60.75 |

12.2 |

|

|

Month |

Sales revenue of economy range |

Sales revenue of luxury range |

Profit economy range |

Profit luxury range |

|

Jan |

756.34 |

193.6 |

113.45 |

48.4 |

|

Feb |

1008.45 |

285.7 |

151.27 |

71.4 |

|

March |

504.23 |

101.4 |

75.63 |

25.3 |

Task 2

Calculating Pearson product moment correlation co-efficient

Correlation co-efficient is one of the most effectual measures which in turn help in assessing the extent to which two variables are highly associated with each other. Such statistical measure is highly significant which in turn helps in determining the impact of one variable on another (Berenson and et.al., 2012). Range of correlation is usually between -1 to 1 which in turn helps in evaluating the impact of variables on each other. Highly positive correlation presents that both the variables incline or decline in the similar direction. On the other side, negative correlation implies that of one variable will incline then other decreases significantly (Black, 2011). Further, zero or no correlation presents that one variable does not affect another to a great extent. Hence, it is highly significant which in turn helps in framing competent strategic and policy framework for the upcoming time period.

Computation of correlation between numbers of units sold in economy range and promotional expenses

|

Month |

Economy (number of units sold) |

Promotional expenses |

|

Jan |

150060.00 |

30000 |

|

Feb |

200080 |

50000 |

|

March |

100040 |

20000 |

|

|

|

|

|

Correlation |

0.98 |

|

Correlation between promotional expenditure and number of items sold in luxury category

|

Month |

Promotional expenses |

Number of items sold luxury range |

|

Jan |

30000 |

23.32 |

|

Feb |

50000 |

34.43 |

|

March |

20000 |

12.21 |

|

|

|

|

|

Correlation |

0.98 |

|

Discussing whether items sold and promotional expenses are highly correlated or not

The above depicted table clearly shows that both the variables such as item sold and promotional expenses are highly correlated with each other. Moreover, correlation between numbers of item sold and promotional expenses account for 0.98. On the basis of this aspect, it can be said that promotional expenses have high level of impact on the numbers of item sold. The rationale behind this, now customer’s decision making is highly influences from the promotional aspects or campaign (Chan and et.al., 2011). Moreover, discounts and other information which is revealed by business entity in advertisement entice the decision making aspect of people to a great extent. Along with this, promotional aspects provide deeper insight to the customers regarding offering and discounting aspect. Thus, by considering such aspect it can be stated that promotional aspects help in enhancing the sales level significantly.

You may also like: Unit 6 Bachelor business HND Business Level 5

Task 3

Assessing the promotional expenses from Jan to December

Allocation of promotional expenses in month from Jan to December is enumerated below

|

Month |

Promotional expenses |

|

Jan |

30000 |

|

Feb |

50000 |

|

Mar |

20000 |

|

Apr |

25000 |

|

May |

32000 |

|

Jun |

38000 |

|

Jul |

48000 |

|

Aug |

50000 |

|

Sep |

49000 |

|

Oct |

46000 |

|

Nov |

52000 |

|

Dec |

60000 |

Preparing sales budget

Economy range

|

Particulars |

January |

February |

march |

April |

may |

June |

July |

august |

September |

October |

November |

December |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecasted sales unit |

91.13 |

121.5 |

60.75 |

58 |

62 |

65 |

70 |

78 |

86 |

100 |

130 |

160 |

|

Price per unit |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

|

Total gross sales |

756.4 |

1008.5 |

504.2 |

481.4 |

514.6 |

539.5 |

581.0 |

647.4 |

713.8 |

830.0 |

1079.0 |

1328.0 |

Luxury range

|

Particulars |

January |

February |

march |

April |

may |

June |

July |

august |

September |

October |

November |

December |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forecasted sales unit |

23.32 |

34.43 |

12.2 |

10 |

9 |

12 |

15 |

17 |

20 |

22 |

28 |

40 |

|

Price per unit |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

8.3 |

|

Total gross sales |

193.6 |

285.8 |

101.3 |

83.0 |

74.7 |

99.6 |

124.5 |

141.1 |

166.0 |

182.6 |

232.4 |

332.0 |

Explaining the aspects that is considered by the manager while setting promotional expenses

In the above depicted table, promotional expenses have allocated by the manager in each month by considering the several factors such as festival, competition etc. Hence, all such aspects are considered by the manager while making allocation of expenses. Moreover, retail business organization is filled up with the high level of competition. Thus, it is vital for the business unit to place emphasis on promotional aspects for developing awareness among the large number of people (Ferrell and Fraedrich, 2016). Hence, by considering such aspect expenses are allocated with the increasing rate or percentage. Along with this, in the month of December large number of companies offer high discounts due to having festive season such as Christmas.

Task 4

Writing a formal business report to the management for presenting findings

|

To, Managing Director, Sales department Date: 24th April, 2017 It is reported to the higher management sales revenue is highly based on the promotional aspects. Moreover, now customers place high level of emphasis on purchasing products from the retailer which offer quality products at affordable price level. In this, by giving advertisements firm can develop awareness among the customers regarding offering. Along with this, it has been assessed from analysis that sales will incline in line with the promotional expenses. Hence, by promoting the products or services retail business unit can attract large number of customers. Further, management team of retail business organization can perform effectually by preparing sales budget. Hence, sales budget will assist company in generating higher return and thereby helps in getting the desired level of outcome or success. Sincerely |

Task 5

Economic order quantity (EOQ)

Economics order quantity is one of the helpful tool for controlling over inventory of organization. In this process, systematic production and distribution of products. It is beneficial for adequate transaction of goods and services. It is order quantity that is useful for cost of inventory management. However, cost effectiveness is created through this process system that affects inventory management as well decision making for further business operations. Therefore, economic order quantity can be understood through following example:-

Manager of Acqua ltd. Water supplier of UK evaluates economic order quantity for producing water supplier services. For this, cost per order is 15000 and carrying cost is 20 annually. Further, company is demand for 500 units per annum and interest charged on this cost is 20. Then, its total size and orders can be evaluated with the help of following formula as:-

|

Carrying cost |

20 |

|

Cost per order |

15000 |

|

Demand |

500 |

|

Interest rate |

20 |

|

|

750000 |

|

EOQ |

866.0254037844 |

Thus, economic order quantity for producing water is 866 that will be appropriate for further business operations as related to production and supplement of goods. However, on the basis of this evaluation, decision can be made for further operations effectively. In this regard, proper management of all goods and services as inventories can get managed sufficiently. However, adequacy of inventories can be gained through this process system that affects on organization's productivity and profitability. It is helpful for further implementation to achieve effectiveness at high level.

Task 6

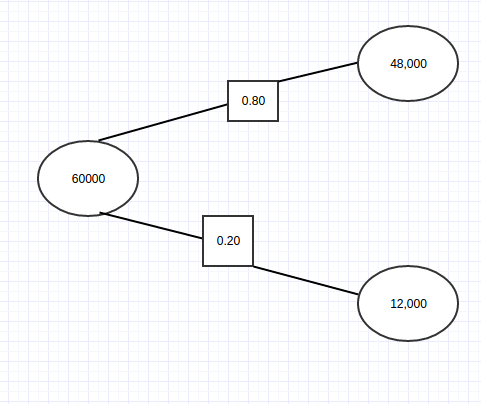

Decision tree

Interpretation: Project manager of organization aanlyzes cost to be flowed supplement for projecting. However, he recognizes that for investing 60,000 on project planning, its 0.80 evaluates as 48,000 while remaining is 12,000. However, for choosing decision related to selecting this project planning is usable for comparing it with other project planning. In this regard, project planning will be succeed through supplying fund.

If cost is incurred as estimated for 120000 then on 0.80, its return is forecast to 9,60,000 as well remaining price is estimated as 2,40,000. In accordance to this, for investing double amount of 60,000 effective outcome will be achieved. However, it is identified that appropriate fund allocation is required for project accomplishment. In addition to this, it would be better for organization to select 2nd project to reach out the set goal. Therefore, systematic project planning can be implemented for decision-making related to investment and business operations. Thus, adequate production and distribution of goods will be effective by implementing all project planning and strategies that is interrelated with productivity and profitability at high level.

Task 7

Calculation of different financial tools

The tool which helps to the company in order to determine that which one project will give more and higher return of the initial investment that will be identified as financial tool. It can be called as an investment appraisal method or capital budgeting techniques also by different firms. When there are two or more kinds of simultaneous project and investments then for assessing viability of one project such kinds of tools are highly considered. Through the respective type of tools the management can know that at which place to open the shop will be profitable and give more return at the end of financial year ending (Baum and Crosby, 2014). In the current scenario there are an entrepreneur going to open a new shop and for which he has two places such as Tung Chung and Causeway Bay. For making decision to open a new place in anyone situation calculation using three financial tools like as NPV, IRR and payback period is given as below:

Net present value

|

Year |

Cash flow of Tung Chung |

Cost of capital 6% |

Present value of Tung Chung |

Cash flow of Causeway Bay |

Present value of Tung Chung |

Present value of Causeway Bay |

|

Initial investment |

600000 |

|

|

1200000 |

|

|

|

1 |

70000 |

0.943 |

66038 |

150000 |

0.943 |

141509 |

|

2 |

70000 |

0.890 |

62300 |

150000 |

0.890 |

133499 |

|

3 |

70000 |

0.840 |

58773 |

150000 |

0.840 |

125943 |

|

4 |

70000 |

0.792 |

55447 |

150000 |

0.792 |

118814 |

|

5 |

70000 |

0.747 |

52308 |

150000 |

0.747 |

112089 |

|

Summation |

|

|

294865 |

|

|

631855 |

|

Less: initial investment |

|

|

600000 |

|

|

1200000 |

|

Net present value |

|

|

-305134.54 |

|

|

-568145.43 |

By considering the calculation of net present value it has been assessed that both are gives negative value of the investment made at the initial which are such as -305134.54 and -568145.43 for Tung Chung and Causeway Bay respectively. Apart from this when making comparison between both it can be said that the Tung Chung place will be better for it because negative return is lower in this case.

Payback period

|

Year |

Cash flow of Tung Chung |

Cumulative cash flow of Tung Chung |

Cash flow of Causeway Bay |

Cumulative cash flow of Causeway Bay |

|

Initial investment |

-600000 |

|

-1200000 |

|

|

1 |

70000 |

-530000 |

150000 |

-1050000 |

|

2 |

70000 |

-460000 |

150000 |

-900000 |

|

3 |

70000 |

-390000 |

150000 |

-750000 |

|

4 |

70000 |

-320000 |

150000 |

-600000 |

|

5 |

70000 |

-250000 |

150000 |

-450000 |

From the above calculation of payback period it can be clearly states that the initial and potential investment is not covered in any place (Irani, 2010). When the entrepreneur will open the new shop in Tung Chung and Causeway Bay places then the initial amount remains up to 250000 and 450000 respectively. Hence, if he wants to make investment then it needs to consider the Tung Chung where less amount is remains at the end of year.

Internal rate of return

|

Year |

Cash flow of Tung Chung |

Cash flow of Causeway Bay |

|

Initial investment |

-600000 |

-1200000 |

|

1 |

70000 |

150000 |

|

2 |

70000 |

150000 |

|

3 |

70000 |

150000 |

|

4 |

70000 |

150000 |

|

5 |

70000 |

150000 |

|

Internal rate of return |

-15.64% |

-13.87% |

The internal rate of return shows that the total investment will give return at the project ending up to which level. Higher the value of IRR of the project then it will be considered for putting money (Bennouna, Meredith and Marchant, 2010). On the basis of IRR it can be ascertained that both the places are not profitable as they are giving negative return which are such as -15.64% and -13.87% for Tung Chung and Causeway Bay respectively.

Discussion to take decision for making investment

From the above computation of all the financial tools like as net present value, payback period, internal rate of return it can be analysed that both the places giving negative return and future value of the investment which is put at the initial level. Apart from this, it can be recommended to the entrepreneur that he should not make and invest money in at any place. But even if he wants to invest then it needs to select the Tung Chung place for open a new shop.

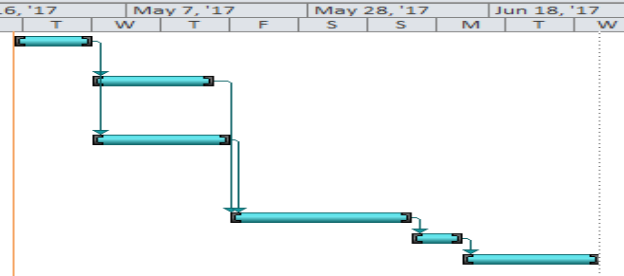

Task 8

On the basis of cited case situation, management team wants to open up new shop within 60 days. Hence, manager is required to make selection of suitable location by taking into account the research plan or activity. Moreover, decision making aspect of the customers is highly influenced from the suitability of location. In this, project management tools or software is highly significant which in turn helps company in assessing the path which they need to follow for accomplishing the project within the less time frames (Yager and Kacprzyk, 2012). Gantt chart is one of the most effectual tools of project management which helps in identifying the relationship that takes place between two or more activities. In this way, Gantt chart clearly shows the relationship which exists between various kinds of activities.

Preparing an activity table showing the work required to open a new shop

Business entity is required to create an activity table or plan by conducting in-depth evaluation of every aspect. Activity table provides deeper insight about the strategies that firm needs to undertake for fulfilling the objectives within suitable time frame. In the absence of having clear and precise plan it is not possible for the entity to make efforts in the right direction (Gerow, 2010). Thus, by keeping all such aspects in mind following plan has been prepared by the researcher:

|

S. No. |

Activities |

Immediate predecessors |

Duration |

|

|

|

|

|

|

1 |

Preparing a plan for investigation |

|

7 |

|

2 |

Conducting secondary analysis to evaluate market trend |

1 |

10 |

|

3 |

Assessment of customers preference towards product or location via survey |

1 |

12 |

|

4 |

Evaluation of data set |

2,3 |

15 |

|

5 |

Selection of location |

4 |

4 |

|

6 |

Opening a new retail shop |

5 |

12 |

|

Mode |

Task Name |

Duration |

Start |

Finish |

Predecessors |

Early Start |

Early Finish |

Total Slack |

Late Start |

Late Finish |

|

Manually Scheduled |

Preparing a plan for investigation |

7 days |

Mon 4/24/17 |

Tue 5/2/17 |

|

Mon 4/24/17 |

Tue 5/2/17 |

0 days |

Mon 4/24/17 |

Wed 5/3/17 |

|

Manually Scheduled |

Conducting secondary analysis to evaluate market trend |

10 days |

Wed 5/3/17 |

Tue 5/16/17 |

1 |

Wed 5/3/17 |

Tue 5/16/17 |

2 days |

Drwaing critical diagram and assessing suitable path

Critical path is the most effectual project management method or tool which in turn helps in identifying the most suitable way to perform task. By following the specific path firm can achieve success in the competitive business environment by completing the project on time.

By taking into account the above mentioned path it can be stated that business entity should follow the path of 1 – 3 – 4 – 5 – 6. By following such path entrepreneur can open up another store within 50 days. Such path will enable firm to accomplish project within less time. If business entity will skip any one of the activity then it may result into delay in the accomplishment of goals.

Conclusion

From the above report, it has been concluded that promotional aspects have positive and significant impact on sales level. Moreover, individuals prefer to purchase products from the retailer from they are highly aware. In this, sales revenue can be enhanced through the means of promotional aspects. Besides this, it also has been articulated that by analyzing and maintaining enough inventory according to EOQ method retail business entity can meet the demand of customers. It can be revealed from the report that project management software enables firm to fulfill the aims within specified time frame. Further, it can be inferred that NPV and IRR methods offer highly valuable framework by taking into consideration the time value of money concept.

References

- Berenson, M. and et.al., 2012. Basic business statistics: Concepts and applications. Pearson Higher Education AU.

- Black, K., 2011. Business statistics: for contemporary decision making. John Wiley & Sons.

- Chan, T.F. and et.al., 2011. The positive correlation between cord serum retinol-binding protein 4 concentrations and fetal growth. Gynecologic and obstetric investigation.

- Ferrell, O.C. and Fraedrich, J., 2016. Business ethics: Ethical decision making & cases. Nelson Education.

- Gerow, K.G., 2010. Biases with the regression line percentile method and the fallacy of a single standard weight. North American Journal of Fisheries Management.

- Yager, R.R. and Kacprzyk, J. eds., 2012. The ordered weighted averaging operators: theory and applications. Springer Science & Business Media.