How to Solve Different Types of Accounting Equations?

15 Feb 2019 4897 6 minutes

How to Solve Different Types of Accounting Equations?

Accounting is the most fundamental thing that is required to build any business and that’s why students need to master this. Keeping such importance in mind, professors keep giving assignments based on different accounting equations so that scholars become pro at solving it. To solve such questions, students need too much concentration and accuracy. And, that’s why they find it a daunting task and seek accounting assignment help. If you too are doubting your skills, then fortunately Global Assignment Help is here to provide you the best writing assistance for solving the accounting equations. But before that, you must know the basics of this subject. So, here it is.

What is Accounting?

Accounting is the process of recording the financial transactions of an organization. Along with recording, it also includes storing, sorting, summarizing, presenting, and retrieving of data. The result obtained after this step-by-step process is then presented in various reports and analyses.

The major purpose of accounting is to give a report over the financial information and know the performance, financial position, and cash flow of a business.

Key Elements of Accounting

To become master of accounting, you need to solve accounting equations. And to do this, you must know the key elements of accounting first. So, to measure the financial position of a company, there are three basic things to know. They are:

Assets

Assets includes what you or your organization owns. For example, cash, inventories, prepaid insurance, and investments.

Liabilities

It is something that the organization owes to someone other and have to pay in certain span of time. For example, loans, accounts or interest payable, and wages.

Capital

It is counted as the difference between assets and liabilities. So, the general equation derived after these three statements is,

Assets = Liabilities + Capital

Students also like to check: Understanding Cellular Respiration Equation

Steps to Solve Different Accounting Equations with Examples

There are mainly five types of accounting problems, they are:

- Accounting equation for a corporate.

- Accounting equation for a sole proprietorship.

- Calculating a missing amount within owner’s equity.

- Expanded accounting equation for a sole proprietorship.

- Expanded accounting Equation for a corporation.

Here, we have discussed each of them. Have a look.

1. Solving Equation for Corporate

The equation you need to follow for solving an accounting problem of corporation is:

Assets = Liabilities + Stockholder’s Equity

Example:

Let’s assume that several members of an organization invest a total of $20, 000 to start a company. In exchange, the corporation issues a total 2,000 shares of common stock. The effect on the corporation’s accounting is:

Asset ($20,000) = Liabilities (0) + Stockholder’s Equity ($20,000)

2. Accounting Equation for a Sole Proprietorship

A sole proprietorship is the kind of business which is run by a single individual, and the equation need to solve the accounting problem on this is:

Assets = Liabilities (no effect ) + Stockholder’s Equity

Example:

Let’s assume, Mr. Bill is the sole proprietor of an organization. He invests funds of $20,000 to start a company. So, after this transaction, the accounting equation will be:

Assets ($20,000) = Liabilities (no effect) + Owner’s equity ($20,000)

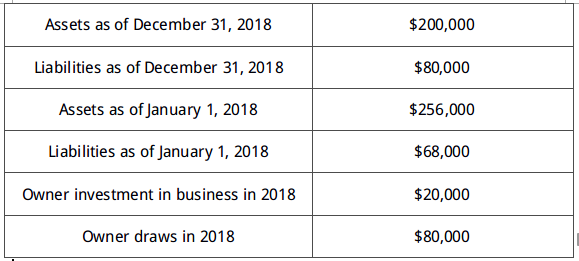

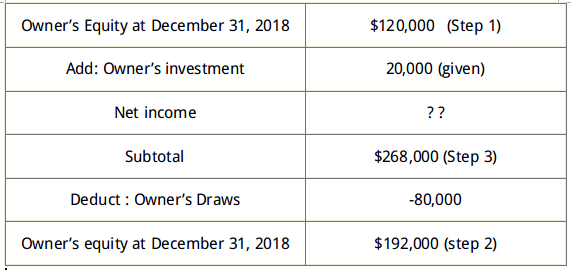

3. Calculating a Missing Amount Within Owner’s Equity

Let’s assume that the net income of an organization for the year 2018 is unknown, but the amount of loans, initial and last balances are known. So, you can calculate the net income easily. Here we have provided an example to show it should be done.

Step 1: Owner’s Equity on January 1, 2018 =$200,000 “ $80,000 = $120,000

Step 2: Owner’s Equity on Dec, 31, 2018 = $256,000 “ $68,000 = $192,000

Adding Owner’s equity on Jan, 2018 and investments, ($120,000 + $20,000= $140,000),

Then subtracting the result ($140,000) from the subtotal, ($268,000 “ $140,000 = $128,000).

So, the net income is $128,000.

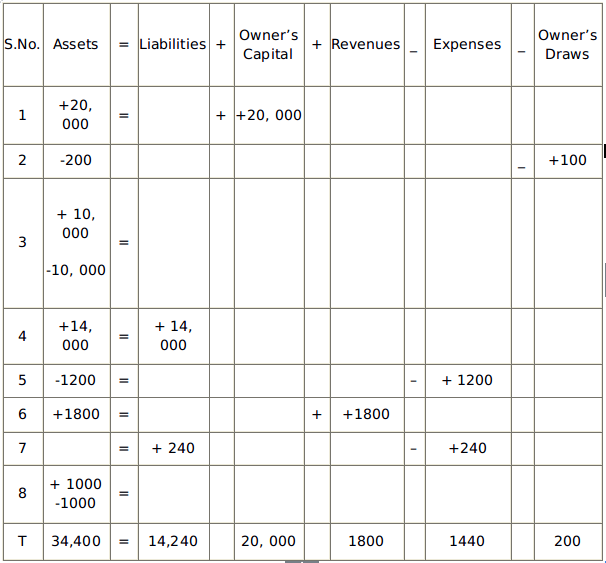

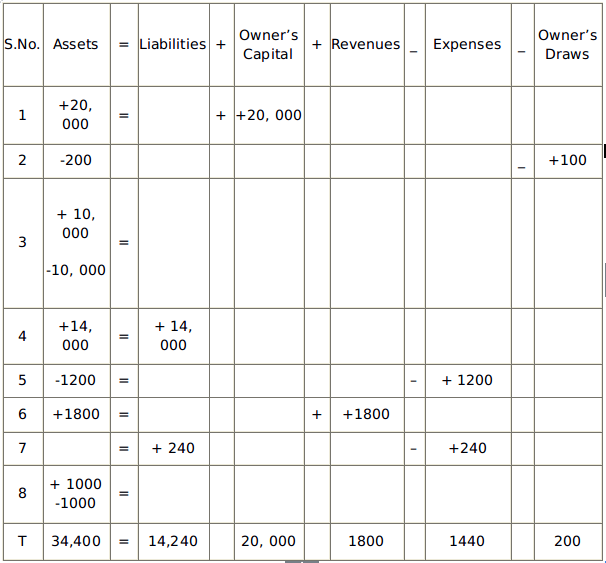

4. Expanded Accounting Equation for a Sole Proprietorship

To solve the expanded accounting problem for sole proprietor, the equation that you should follow is,

Assets = Liabilities + Owner’s Capital + Revenues “ Expenses “ Owner’s Draws

Example

The expanded form of accounting problem for a sole proprietorship has been explained below.

So, now you can calculate the net income.

Revenue - Expenses = Net Income

1800 - 1440 = 360

5. Expanded Accounting Equation For a Corporation

Here is the formula to solve the expanded accounting equation for a corporation.

Assets = Liabilities + Paid-in Capital + Revenues “ Expenses “ Dividends “ treasury Stock

Example:

The same problem that we have solved in expanded accounting of sole proprietor, we will solve it here too as the expanded equation of a corporation. So, here it is.

Here, you can also calculate the net income easily, just by subtracting the expenses from the revenue, i.e:

Revenue - Expenses = Net Income

1800 - 1440 = 360

So, these are five basic types of accounting equations. Hope you have found these solutions easy and accurate. You must have also understood what is accounting, its purpose, and key elements to do the calculations.

Check out these blog:

Free Tools

Paraphrasing Checker Tool

Easy to Use Paraphrasing Tool to Simplify Complex Academic Writing

Check Now

Dissertation Outline Generator

Get Structured Outline by Professionals for Your Dissertation

Check Now

Referencing Tool

Effortlessly manage citations and references with our smart referencing tool

Check NowLowest Price Guarantee

Get A+ Within Your Budget!Price Calculator

Offers & Benefits

Get upto 56% OFF on Your First Order !

Offers Benefits

Other Services

Latest Blogs

- 20 Mar 2025

- 597 Views

- 04 Mar 2025

- 494 Views

- 28 Feb 2025

- 583 Views

- 25 Feb 2025

- 337 Views

Thank you for submitting your comment on this blog. It is under approval. We will carefully review your submission and post it on the website.